I'm not ashamed to say that I am a shopaholic. I got my first college credit card with a $1200 limit my freshman year and since then, I've maxed it out several times, had to have my parents bail me out (so to you, parents. Thanks again), and then maxed it out again. I also now have a Target credit card and an Amazon credit card (which I have sworn I'm not going to use until my bank card is paid off).

I have two summer jobs and my parents help me out with rent and groceries so you'd think I'd just be rolling in it. You'd think wrong. It is impossible for me to save money. To me, saving money is similar to losing weight. To lose weight, you can either eat healthier or exercise. And if you're exercising then you have an excuse to eat junk. It's the same with saving money, you can either work your butt off and bring in a lot of money or not spend money. I have troubles with the second part because I'm making money so I think I have an excuse to spend it.

I love the idea of saving money; watching your bank account grow and counting down to buy something big with actual money and not using credit...I just cannot stop shopping. I shop when I'm stressed to relax, I shop when I'm happy to celebrate, I shop when I'm sad to cheer myself up, and I shop when I'm bored or when I haven't shopped in a while. It's an actual addiction. First step is admitting you have a problem, right?? Well, this is me admitting it.

It really hit me that I need to get my life together last Friday: pay day! My direct deposit just transferred into my account and I was feeling pretty good. Then I looked at my balance on my credit card. And then I remembered I had to pay on my Target credit card, too. And then I remembered I had to pay utilities. As I mentally subtracted everything from my check, I felt my heart drop. $20. TWENTY. As I checked my math and considered selling my kidney, I realized I needed a change. I could potentially work my butt off all summer and end up with nothing by the end of it because I'm obsessed with buying post-its. (WHY do I have so many post its??). I decided that that is unacceptable.

"I'm not going to spend any money for the rest of the month!" I decided. I paused. "Ehh... maybe a week. We'll start small." So, here I am. Please pray for me. I'm going to need it.

Stage 1: Over-confidence

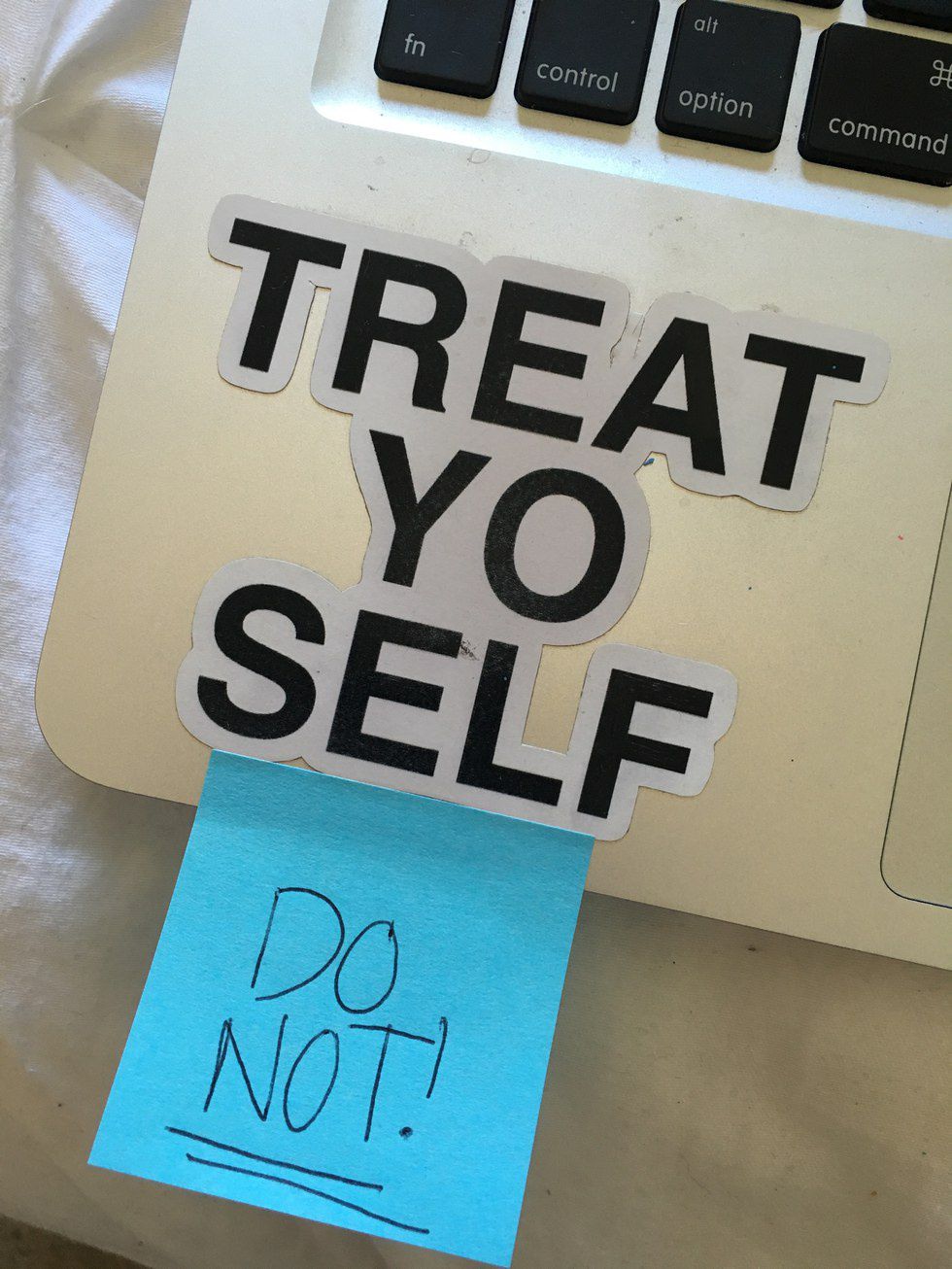

All right, Day One! In order to get myself ready for this project, I had to set myself up for success. I started by writing the intro to this article so that I had to stick with it in order to finish this piece (future me, please finish this). Then I put my plethora of post its to work. Reminders. Every where. Especially on my laptop. I'm pretty sure that if I didn't have access to online shopping I'd be a millionaire.

Next, I had to deal with my credit card. If I was going to make it through this week, I needed credit to not even be an option. Giving it to my roommates wouldn't work because I am a professional snooper and I can find anything someone hides from me. Anything. So the only solution was to freeze my credit. Literally. It's in a block of ice in my freezer as we speak. Extreme situations call for extreme measures.

Stage 2: Panic

After all of this, I started realizing what I had just signed up for and all of the essentials I was running low on. I started making a list of all of the things that I wanted to buy then threw it in the trash. Looking at it made me panic even more. What if I died tomorrow and never got to experience that watermelon slicer that they are selling on TV for $19.99? And if I order now, I'll get a second one free! How can I pass up this offer?! More importantly, how was I going to make it through a whole week of this torture?!

Stage 3: Bargaining

"If it's already on my Starbucks card, then it doesn't count."

"I had a gift card so it doesn't count."

"I used my Fuel Saver Rewards so it doesn't count."

"Maybe I'll just count spending on my credit card and my debit card is fair game."

Stage 4: Grief

After realizing that I chose the absolute worst week to not spend money, I started feeling the effects. My friends were going to the pool, going out to eat and ordering things online while I sat watching. I foraged through my cupboards like a freakin' caveman to find things to put together as a "meal." Most nights just putting a lot of snacks together until I was somewhere near full. I actually cried when I got an email from Kate Spade with an amazing one-day sale that I couldn't partake in.

Stage 5: Acceptance

You may think that this means acceptance that I don't need to spend money; that I can make it a week without spending a single cent and I would retain my sanity. You would be wrong. No, this feeling of acceptance comes from the realization that I am in fact a shopaholic and that even though I wasn't able to make it a week without spending money (I caved on cookie mix, Target sale items and spray butter for popcorn) doesn't mean I can't get my finances in order.

After this traumatic experience, I learned a lot. For instance, I learned that although popcorn may feel filling at the time, you probably shouldn't eat it as a meal before you go to work for an eight hour shift. More importantly, I learned that I need a budget, like yesterday.

Stay tuned next week as I attempt to build a budget and comment with any tips you may have!