I guess my journey with the Passion Planner really began on Friday, March 3, 2017 as I logged onto my school account to check my chemistry exam grade.

"Damn," I thought to myself. "I really need to get my life together." I'm not sure what led me to the Passion Planner website, but that following Monday, I decided I would give it a go. Just a quick heads up though, this gorgeous new addiction of mine used 167 of my precious prints at school.

If you are unfamiliar with Passion Planner, here's the run-down: this planner is supposed to be your new best tool to plan short and long-term goals, and actually achieve them. It incorporates challenges as well as reflections on your daily, weekly, and monthly life. There is even a mid-year check-in. This planner was born out of the overwhelming fast-paced lifestyle we all live now.

It's supposed to be the perfect planner — one used to help those who are lost, find their way. Let me just say, as soon as I started on day one, I was entirely hooked. I brought it to the grocery store just to show it off to my friend! I could hear the gods of all micromanagers sing a heavenly choir to me as I started the roadmaps (more on that later). I was actually planning things in my Passion Planner.

Basically, this nifty planner is supposed to help you prioritize your goals and gives you several tools to work towards them daily. And yes, there are constant reminders that you're doing well on your journey (can I get an amen from the anxious folk in the back).

When I first logged on to the Passion Planner website, I was instantly disheartened to see that the planner was thirty dollars, and the ones that were half-off were sold out — bummer. However, there's this tab called "downloads", where you can have PDF format access to not one but all of the planners! For free! "No excuses now," I thought to myself as I fatefully shared the photo on my Instagram page. Within a few moments, I received a confirmation e-mail with the password to unlock the planners, the key to finally getting myself together. I printed, hole-punched, and threw the planner in an old binder. I won't lie, it takes a bit of time to get it all together at first.

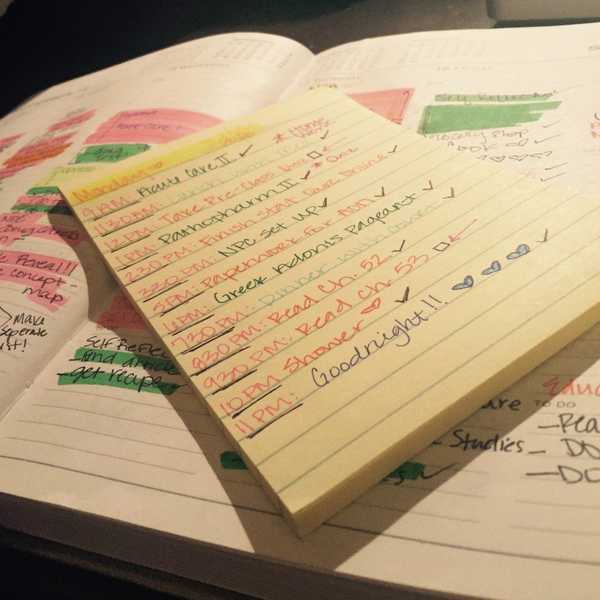

When you first begin to set up your planner, there is a page where you set goals for yourself — three months, one year, three years down the road, and even life time goals! This is basically like a five minute free write of all of the things that you wish you could do. If you could do or be anything in this time frame, write it, and don't worry about explaining yourself to other people. I found that not only was it relaxing to plan my day in half-hour increments, but it gave me something to look forward to each day. I challenged myself in Starbucks in the morning to plan out my day even more than I did on Sunday night, and to set my daily focus, i.e., what can I do today to reach my goals and better myself as a person?

In addition to the reflections and the made-easy time management, you are also prompted to make a "roadmap" of how you can achieve your goals. This is basically a mind-map of ideas that you brainstorm and can apply to your everyday life — another free writing session. For example, my lifetime goals are far away but what can I do today to ensure that they come true? In this roadmap, you are also asked to set deadlines. I like this a lot considering that I am still trying daily to better myself as a teammate, which was my New Year's Resolution. I can lay this out in a roadmap of different daily tasks and ideas that will help to ultimately reach this goal I've set for myself, with deadlines for each of them.

I made a list of pros and cons for the planner. Pros are that if you struggle at all with time management, then this is the planner for you. Your day is perfectly laid out from 6 a.m until 10:30 p.m., in half-hour increments. You have space to lay out your life daily, weekly and monthly, with a reflection at the end of each one. This planner lets the micromanager micromanage themselves! The cons though, I found were few and far between. It does take close to what I'd consider an eternity to print this planner, otherwise, you're shelling out $30 for it. It also takes a while to set up the undated planner; you have to write in all of your dates in the monthly and weekly calendars. You also have to know the purpose behind the planner, which means reading the first few pages, for it to work the way it is supposed to work.

After one week with my Passion Planner, I don't think I'm going back anytime soon. Sure, I got made fun of for having to have the perfect Pinterest-worthy planner pages. Sure, my best friend is tired of hearing me say "Oh my gosh! Let me Passion-Plan this!" or, "Let me check my planner!" before we hang out — yes, I block out the times we hang out. All in all though, I didn't realize how much time I actually don't have. Realizing that I have to say no actually compels me to say no now, and that leads me to have a less stressed out life. Knowing the times that I have blocked out for literally everything in my life now leads me to manage my time better, which leads to better study habits, and better living in general.