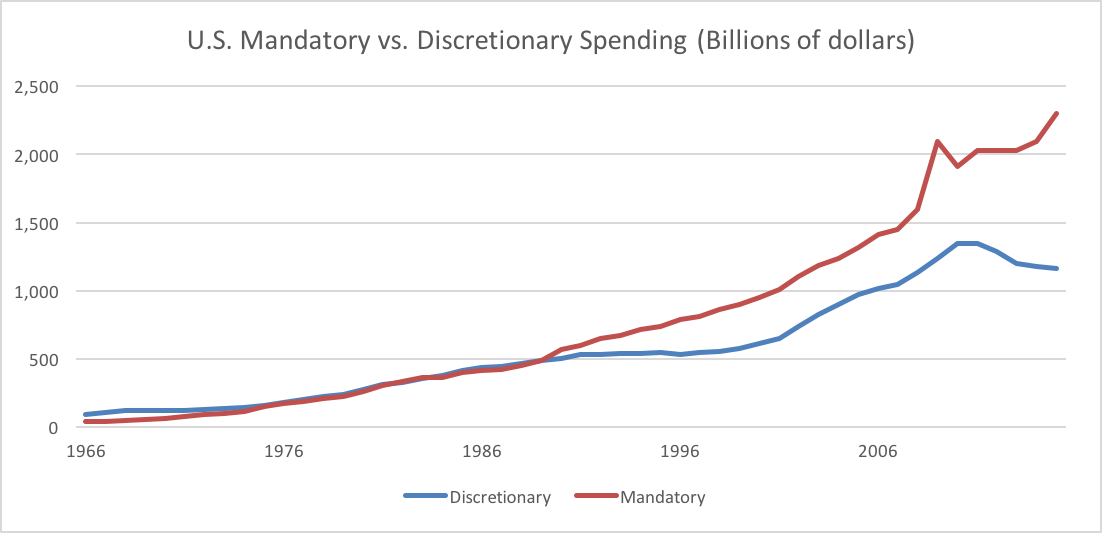

There are two main types of spending: mandatory and discretionary. Understanding the difference between the two is key to making the most of your pay stub.Mandatory spending is required by law or by your contract with your employer. This might include things like Social Security and Medicare taxes, state and federal income taxes, and contributions to retirement plans.Discretionary spending is optional, and includes things like entertainment, dining out, and travel.It's important to be aware of the difference between mandatory and discretionary spending, because the two can have a major impact on your take-home pay.

For example, if you have a lot of discretionary spending and not much mandatory spending, you'll end up with a smaller pay check.On the other hand, if you have a lot of mandatory spending and not much discretionary spending, you'll end up with a bigger paycheck but less money to spend on the things you want.There's no right or wrong answer when it comes to how much you should spend on each category. The key is to be aware of the difference so you can make informed choices about how to use your paystub maker.

What is a pay stub?

Your paystub is an important document that shows your earnings for a specific pay period, as well as deductions taken out of your paycheck. Here's what you need to know about your paystub. The first thing you'll see on your paycheck stub abbreviation is your gross pay, or the amount of money you earned before taxes and other deductions are taken out. Your gross pay will be listed by the hour, if you're paid hourly, or by the week, if you're paid weekly.Next, you'll see your deductions. These are the amounts that are taken out of your paycheck for taxes, insurance, and other benefits. The most common deductions are federal and state taxes, as well as Social Security and Medicare.

Finally, you'll see your net pay, or the amount of money you take home after all deductions have been made. This is the amount of money that will be deposited into your bank account or that you'll receive in your paycheck, if you're paid in cash.

Your paystub is an important document that can help you keep track of your earnings and deductions. Be sure to review your pay stub carefully so that you understand where your money is going. If you have any questions, be sure to ask your employer or HR representative.

How to Make the Most of Your Pay Stub

Are you making the most of your pay stub? If you're like most people, the answer is probably "no."A pay stub is a document that shows your income and deductions for a specific pay period. It's also a great tool for budgeting and tracking your spending.But too often, people treat their pay stubs like they're trash. They stuff them in a drawer and never look at them again.Don't let this happen to you! Your pay stub is a valuable resource that can help you make smart financial decisions.

Here are some tips for making the most of your pay stub:

1. Know your mandatory vs. discretionary expenses.

Mandatory expenses are those that you have to pay, like rent, utilities, and groceries. Discretionary expenses are optional, like entertainment, eating out, and travel.Knowing the difference between mandatory and discretionary expenses can help you make better spending decisions. For example, if you're trying to save money, you might cut back on discretionary expenses first.

2. Track your spending.

Your pay stub can help you keep track of your spending. Each time you get paid, take a look at your pay stub and compare it to your budget.Do you see any areas where you're spending more than you planned? If so, you can make adjustments to stay on track.

3. Make a savings plan.

Saving money can be tough, but it's important to have an emergency fund and to save for long-term goals like retirement.Your pay stub can help you figure out how much you can afford to save. Each pay period, set aside a fixed amount of money into a savings account.

4. Invest in your future.

In addition to saving for retirement, you might also want to consider investing in your future. This could include things like taking classes to improve your job skills or investing in a side business.Your pay stub can help you figure out how much you can afford to invest. Then, you can start working towards your goals.

Mandatory vs Discretionary Spending

Making the most of your pay stub requires understanding the difference between mandatory and discretionary spending.

Mandatory spending is spending that is required by law or necessary for survival. This includes things like taxes, rent, and food. Discretionary spending is spending that is not required and can be cut back if necessary. Mandatory vs Discretionary spending includes things like entertainment, travel, and dining out.

- The first step to making the most of your pay stub is to make sure that your mandatory expenses are covered. This means making sure that you have enough money to cover your taxes, rent, and food. Once your mandatory expenses are covered, you can start to focus on your discretionary spending.

- One way to make the most of your discretionary spending is to set a budget. This way, you can make sure that you are not spending more money than you can afford. Another way to make the most of your discretionary spending is to save up for big purchases. This way, you can make sure that you are getting the most bang for your buck.

Making the most of your pay stub requires understanding the difference between mandatory and discretionary spending. By understanding this difference, you can make sure that your mandatory expenses are covered and that your discretionary spending is done in a way that is responsible and within your budget.

Going to the cinema alone is good for your mental health, says science

Going to the cinema alone is good for your mental health, says science

women in street dancing

Photo by

women in street dancing

Photo by  man and woman standing in front of louver door

Photo by

man and woman standing in front of louver door

Photo by  man in black t-shirt holding coca cola bottle

Photo by

man in black t-shirt holding coca cola bottle

Photo by  red and white coca cola signage

Photo by

red and white coca cola signage

Photo by  man holding luggage photo

Photo by

man holding luggage photo

Photo by  topless boy in blue denim jeans riding red bicycle during daytime

Photo by

topless boy in blue denim jeans riding red bicycle during daytime

Photo by  trust spelled with wooden letter blocks on a table

Photo by

trust spelled with wooden letter blocks on a table

Photo by  Everyone is Welcome signage

Photo by

Everyone is Welcome signage

Photo by  man with cap and background with red and pink wall l

Photo by

man with cap and background with red and pink wall l

Photo by  difficult roads lead to beautiful destinations desk decor

Photo by

difficult roads lead to beautiful destinations desk decor

Photo by  photography of woman pointing her finger near an man

Photo by

photography of woman pointing her finger near an man

Photo by  closeup photography of woman smiling

Photo by

closeup photography of woman smiling

Photo by  a man doing a trick on a skateboard

Photo by

a man doing a trick on a skateboard

Photo by  two men

two men  running man on bridge

Photo by

running man on bridge

Photo by  orange white and black bag

Photo by

orange white and black bag

Photo by  girl sitting on gray rocks

Photo by

girl sitting on gray rocks

Photo by  assorted-color painted wall with painting materials

Photo by

assorted-color painted wall with painting materials

Photo by  three women sitting on brown wooden bench

Photo by

three women sitting on brown wooden bench

Photo by

Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by

people sitting on chair in front of computer

people sitting on chair in front of computer

all stars lol GIF by Lifetime

all stars lol GIF by Lifetime two women talking while looking at laptop computerPhoto by

two women talking while looking at laptop computerPhoto by  shallow focus photography of two boys doing wacky facesPhoto by

shallow focus photography of two boys doing wacky facesPhoto by  happy birthday balloons with happy birthday textPhoto by

happy birthday balloons with happy birthday textPhoto by  itty-bitty living space." | The Genie shows Aladdin how… | Flickr

itty-bitty living space." | The Genie shows Aladdin how… | Flickr shallow focus photography of dog and catPhoto by

shallow focus photography of dog and catPhoto by  yellow Volkswagen van on roadPhoto by

yellow Volkswagen van on roadPhoto by  orange i have a crush on you neon light signagePhoto by

orange i have a crush on you neon light signagePhoto by  5 Tattoos Artist That Will Make You Want A Tattoo

5 Tattoos Artist That Will Make You Want A Tattoo woman biting pencil while sitting on chair in front of computer during daytimePhoto by

woman biting pencil while sitting on chair in front of computer during daytimePhoto by  a scrabbled wooden block spelling the word prizePhoto by

a scrabbled wooden block spelling the word prizePhoto by