What is a carbon tax? What does it mean? What does it do??.. Do we even need it??

Well for starters, a carbon tax is considered the only method in which carbon users are held responsible for climate damage resulting from carbon dioxide emissions into the atmosphere. There are essentially two methods to hold users accountable for the damage they’re inflicting with their emissions: a carbon tax or a cap-and-trade system.

With a carbon tax, there is an imposed fee on carbon emissions. With a cap-and-trade system, there is a set limit as to how much carbon emissions companies can have and when they exceed their limits are then pressured into paying other companies for their unused quotas, and as years pass the limit (“cap”) is decreased thus moving towards becoming more and more environmentally conscious.

The U.S has actually successfully instilled cap-and-trade systems for other types of emissions in particular that of sulfur dioxide and nitrous oxide, reducing acid rainfall by almost 50% since the 1980’s. A carbon tax is much quicker and easier to put in place than a cap-and-trade system. But when it comes to a cap and trade system there are more clear boundaries as to how exactly and by how much carbon emissions are lowered as opposed to the uncertainty a carbon tax has.

Ultimately putting a restriction on emissions by either method is likely the most powerful tool a government can use to pressure companies to move in a more environmentally aware direction. When it comes to actually deciding which method to implement it really depends on how each is customized to the country at hand and they actually are quite successful if used in conjunction with one another.

Carbon dioxide which is produced when hydrocarbon fuels like petroleum, coal, and natural gas are combusted and has a negative impact on the climate due carbon dioxide being a heat-trapping greenhouse gas. So yes carbon emissions are more than just a little problematic when it comes to the environment.

The United States accounts for 1/7 of the world’s greenhouse gas emissions so it certainly has some sort of obligation to lowering emissions like other nations have stepped up and done so.

On one hand, larger companies can and will relocate overseas to countries where there is no fee for carbon emissions which defeats the purpose of making the world more environmentally conscious and sound. But you can’t change the world immediately but you can change the way people think about things.

Sure a carbon tax won’t immediately decrease carbon emissions but it’s a step forward and there are certainly companies that support the idea of being more environmentally conscious. This provides an incentive for companies who are willing to change their ways and move towards a more green approach towards things.

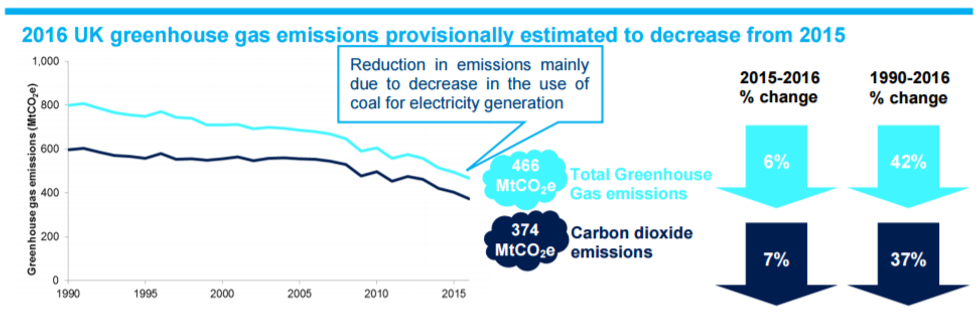

Countries like Denmark, Finland, Germany, the U.K, Ireland, and Italy have some variant of a carbon tax. Countries that have carbon emissions restrictions have indeed found success in lowering emissions so it’s not something that will have no impact whatsoever if anything far from it. The U.K has found immense success in dramatically lowering CO2 emissions and has been successful in offsetting higher prices for carbon-emitting products like gas with tax refunds elsewhere.

And in the three years that Australia had a carbon pricing mechanism (set at $19/metric ton of carbon dioxide equivalent and rising annually), emissions in affected sectors fell from 1.5 to 9 percent. Street lighting changes in Oslo have proven to save money and reduce its carbon footprint by switching to LED streetlights.

The U.S also found this to be true when in Boston 40% of streetlights were converted to LED lights in 2012 which saved the city $2.8 million and factoring reduced costs and saving a payback period of fewer than three years.

A very touchy subject is economic impacts a carbon tax might have. It is a Pigovian tax thus it’s taxation put in place to offset a negative external cost. It can be a regressive tax and does have the potential to negatively impact lower-income groups disproportionately. Lower income families spend more of their income on energy than higher-income families.

It’s true there’s a big negative impact potential as The Wall Street Journal writes, “the Congressional Budget Office estimates that the price hikes from a 15% cut in emissions would cost the average household in the bottom-income quintile about 3.3% of its after-tax income every year.

That’s about $680, not including the costs of reduced employment and output. The three middle quintiles would see their paychecks cut between $880 and $1,500, or 2.9% to 2.7% of income. The rich would pay 1.7%”.

But, tax revenues can be used to offset that. Anna Chette wrote for University of Pennsylvania's Wharton Public Policy Initiative online publication explaining how a carbon tax can be beneficial. She found that “the economic benefits of a steadily increasing, revenue-neutral carbon tax are multi-layered.

The money gained from the tax and then returned to American citizens will stimulate spending, contribute to the national GDP, and create jobs; the tax will also correct the negative externality of carbon and associated pollutants and decrease mortality, providing additional economic benefits”.

A carbon tax has the potential to be regressive in nature but it’s really not indicative of the tax itself but how policy-makers decide to distribute the resulting revenue. Carbon restrictions undoubtedly can negatively impact the economy when it comes to GDP, jobs, etc., but if there have been so many countries that have been successful in implementing them then certainly it can’t be all that bad?

Yes, each country is different and different industries impact them differently but if anything the U.S should be one of the most sound nation with the most positive potential towards carbon taxation.

A carbon tax is far from perfect, and there are all sorts of dirty tricks and loopholes that can be taken, but it’s still a step in the right direction to put in place a carbon tax. People don’t like the idea of products and services raising in cost but it can be offset if the carbon tax is thoroughly thought out.

There are already multiple states within the United States making promises and plans to instate carbon taxation. There are problems with a carbon tax like the fact that we don’t have the technologies capable of lower carbon emissions but having a taxation in place pushes us to work towards creating those.

The United States is the land of innovation and progress. So if we can do it in other sectors and aspects of life, who’s to stop us and say that we can do it when it comes to carbon emissions?

So yes a carbon tax is a good idea and something we as Americans should pride ourselves on wanting and aiming for.