Students in debt are joining the growing number of $1.2 trillion dollars in student loan debt that numerous non-graduated and graduated students have found themselves in.

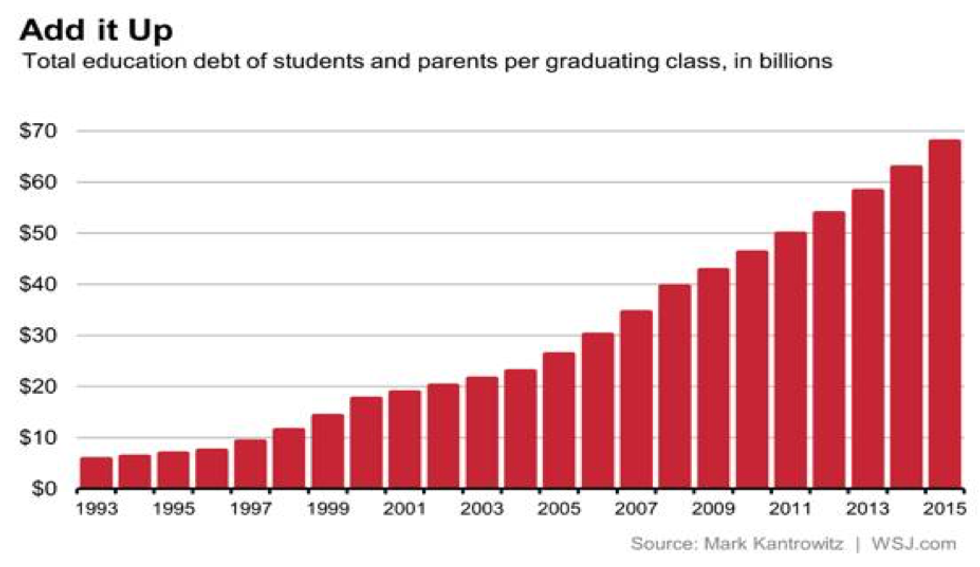

Student loan debt is a continuously advancing problem in the United States. With tuition constantly rising, debt is skyrocketing.

Now, in the U.S., a Bachelor’s degree won’t do many too well, in regards of being provided a job and desired (yet reasonable) pay, compared to a few decades ago.

Not all, but some students continue pursuing a higher degree in order to meet the qualifications for the lifestyle they desire.

To further one’s education, students are being left with little-to-no option other than to continue accepting student loans.

Amy Thomas, working with Financial Help at Arizona State University, is constantly dealing with questions parents and students have and recognizes what she feels the main problem is when dealing with student loans.

“My best advice is to not take the full amount of loans that you’re eligible for,” Thomas said. “I think taking out the maximum is the biggest mistake. Only take out what you need to cover for your education.”

Being informed and completely aware of every aspect of the student loan being taken out should be a priority, according to Thomas.

“Looking at the interest rate and knowing the difference between subsidized and unsubsidized loans is important,” Thomas said. “Generally, the federal student loans will have the best interest rate you can get, and you must monitor interest rates and know exactly where you’re at with your student loans.”

Some will argue accepting student loans isn’t worth it, but others say under certain circumstances, it may be worth while.

“If taking out student loans is the last thing you have to do to further your education, then yes, I’d say accepting the loans is a good thing,” Thomas said.

There are students who, instead of taking out loans, pay for their schooling through scholarships, grants, work study within the school, and out of pocket, all of which Thomas recommended over loans, if possible, to anyone considering progressing their education.

The opportunity some have to not be placed in debt after college is astounding, but this does not mean the topic and discovering solutions to student loan debt is dismissible.

The problem with student loan debt isn’t solely the negligence or struggle of paying the debt off; some companies have been reported making false promises of student debt relief.

The results of these false promises have potential to be detrimental.

There’d been promises of student debt relief made by Student Financial Services that wouldn’t fall through, lacked truth to statements provided to loan borrowers, and when questioned, officials of the company said they didn’t intend to mislead their customers, according to Robert Anglen, news reporter with the Arizona Republic.

Many complaints have been made towards Student Financial Services, but since the complaints have been made, the company said it fired several employees that made such misleading promises, according to Anglen.

False promises made by student loan companies are only aiding in the rising education debt in America, but cracking down on any company being dishonest with its borrowers is difficult.

Statistics from Student Loan Borrowing and Repayment Trends 2015 have shown approximately 43.3 million Americans are borrowers of student loans, and the average age of those that continue to pay off their debt is 20-30 years old.

Borrowers of federal student loans are put on a standard repayment plan and are expected to pay off their debt in 10 years, but research shows it takes approximately 21 years for the average bachelor’s degree holder to pay off their loans, according to Allie Bidwell, staff writer for U.S. News.

As Thomas said earlier, if taking loans out is the last resort to further one’s education it isn’t an option to completely shy away from, and luckily, some students recognize that.

Carter Irwin, finance and business law major at ASU, is a student who hasn’t accepted student loans yet but says he’ll have to when he enters graduate school.

“If that’s the only option then the value of getting your degree is greater than that money that you’re paying in interest,” Irwin said.

The idea of student loans is with the bank you get a lump sum, you pay your tuition, and then there’s interest that you accrue, according to Irwin.

“That’s the downside of loans,” Irwin said. “You have to pay a larger amount than you originally borrowed and that’s how the banks make money.”

Irwin already envisions his plan to fund his education.

“Getting my masters degree will hopefully get me to start at a higher salary so I’ll make more money and be able to pay off my debt quickly,” Irwin said. “I plan to budget my payments into my income.”

Not all students are taking these loans out, but refusing to accept student loans to avoid debt isn’t promised to be the better decision.

Makensey Muridan, a student at Chandler-Gilbert Community College, chose to avoid student loan debt as much as possible by continuing her education at a community college after she graduated high school.

Muridan approves of her decision, although it wasn’t a decision she wished she felt she had no better option to choose from.

“It's [loans] caused me to miss out on a lot of opportunities. I’ve cut back on spending, and it's not as memorable of an experience,” Muridan said. “College isn’t all about the experience, but it’s an opportunity to grow, and I feel like there's more of those opportunities at universities.”

The ability to pay for school as-you-go doesn’t mean students are enjoying the benefits of more luxury items, higher-quality and additional meals, and other opportunities students in debt may not be able to take advantage of.

Matt Kuebler is in his third year at ASU, and he was fortunate enough to successfully apply his knowledge of how to pay off his student debt.

Unfortunately, paying off his finances to continue his education has meant cutting out some meals and not going out to eat as much as desired, according to Kuebler.

“Funding my own education requires me to live a budgeted lifestyle. I do have to limit my free spending and sometimes eat less than normal,” Kuebler said.

The simple, seemingly complex, way to avoid or pay off student loans is knowledge and motivation.

Understanding how long it’ll take to pay debts off, how to save money, how one is to budget their lifestyle until the debts are paid, and if any additional costs will be applied is crucial when accepting loans.

These skills will be beneficial when trying to pay off any debt, not limited to student loan debt.

For someone to be able to know their spending limit after college on a daily basis does matter because knowing how to budget is a learned skill that will help one get out of debt if they strive to do so.

An ASU student shared a little bit of her experience when discussing how her family funds her education.

“My parents had been saving up for a while, so they didn’t take out loans to pay for my schooling,” Tiffany Vanta said, a sophomore at ASU.

Similar to Kuebler, Vanta said she notices she eats more and enjoys more benefits at home in California, opposed to when she’s living near ASU’s campus.

“I was taught how to save my money, know when to spend and what to spend it on, and it’s not only going to help me through college, but after as well,” Vanta said. “No, ironically, I didn’t learn how to budget in high school, but that would have been helpful.”

People aren’t informed enough about what position they’re placing themselves in and how to get out of it, according to Vanta.