As college students, we all know the struggle to save money wherever possible isn't always successful. With limited funds, we sometimes have to make the choice between buying books and buying our favorite snacks. As a former extreme couponer, I have a bit of experience saving money. Yes, I have walked out the store with carts of stuff without paying a cent and I have also been paid by the store. However, saving money as a college student doesn't have to get that extreme. There are some really easy tools that can lead to great savings as you navigate the new adult world.

1. Save money buying textbooks.

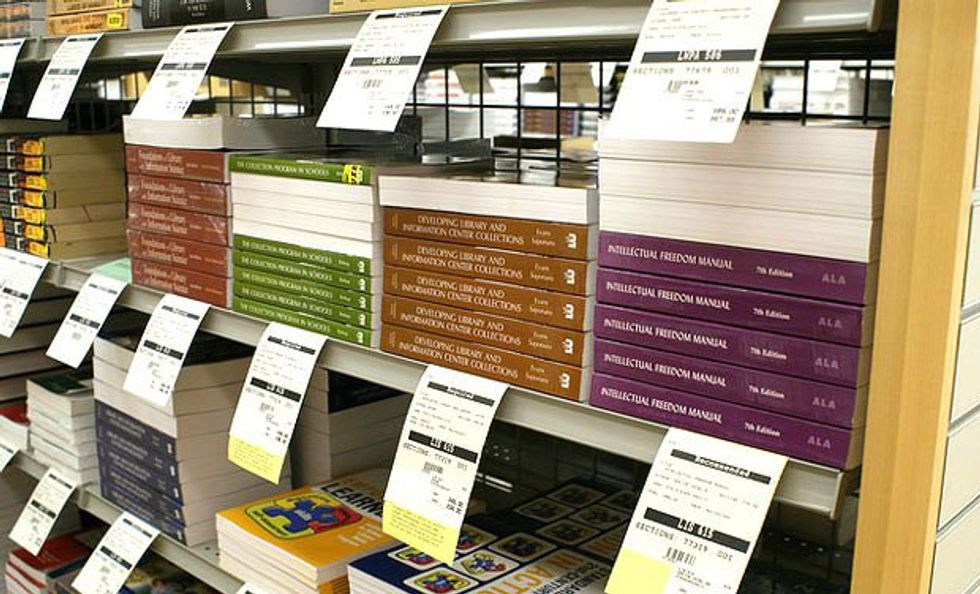

Costly textbooks that you might crack open once or twice are honestly the worst. I wish teachers would just be honest, we probably don't need half of these books. Save yourself some money and ask people who have taken the class if the book is even necessary. If the answer is no, see if you can borrow one from a friend or the library in the event of actually needing the book.

Sometimes you honestly do use the textbook so having your own copy is necessary. That being said, don't pay full price. See if you can buy used copies from other students on campus or check out my personal fave slugbooks.com. Slugbooks compares prices to buy or rent the textbook you need across multiple platforms so you always get the best possible deal. My first semester I made money selling my books back to the bookstore because of the great deals the site found. In my second semester I got my $300 accounting book for six dollars.

2. Download store apps to save money.

Even students on a meal plan will probably find themselves at the grocery store for a few snacks or even all your groceries. You don't have to clip coupons all day on your industrial paper cutter or create elaborate spreadsheets to save money. One of the easiest ways to save is to download apps for the stores you want to shop at. Most grocery stores have apps which can store information on loyalty cards and in store coupons. Sign up for loyalty cards where you are shopping (it often leads to better prices and the ability to use money saving coupons). Target has the app Target Cartwheel. Just scan the barcodes in your cart and the app will pull up discounts that apply. Scan the app at checkout and you can easily save a little money.

3. Skip the bottled drinks.

Buying drinks on college campuses can quickly add up in price. Apart from being better for you, cutting out or limiting your consumption of bottled beverages can be better for your budget. Whether you are paying in cash or using a meal plan, you can male your money go further by not adding on extras with every meal. The same goes for buying sodas when you go out to eat. Soda is one of the biggest mark ups at a restaurant. By ordering water instead of a Coke, you can keep the bill down and save the money for something you actually really want. But f you really want a drink, it's a lot cheaper to buy from the grocery store and indulge at home.

4. Utilize student discounts and promotions.

Student discounts often exist but are not always advertised. It doesn't hurt to ask if one exists, and if you find a really great discount frequent the store that offers it. Movie theaters, tourist attractions and sometimes even retail stores offer a discount with your student ID. Utilize that potential savings.

Your university email can also unlock a treasure trove of discounts. You get six months free of Amazon Prime with your email and half off the service after your trial ends. Some stores offer special deals for move in and college gear with that email. Check what you can save just by being a student. I got Photoshop for under $300 when the price on Adobe's website was $1000 — just with a student discount!

5. Use cash back sites.

If you are already going to be making online purchases, whether it be clothes, books or gifts, make sure you get rewarded for it. Sites like ebates or swagbucks give you gift cards based on online spending. When I bought a new suitcase set I turned the rewards into Amazon gift cards to buy my textbooks. Other times I have turned clothing purchases into points toward a Sephora gift card. My makeup habit is rather costly, so any little bit helps.

6. Skip the coffee bar.

At nearly five bucks a cup, your daily coffee quickly adds up. You would be surprised how many of your favorite drinks can be made in your dorm, no costly supplies needed. I spent over a year working in a coffee shop and I'm going to be honest, it's really not that complicated. I made cold brew coffee using a slurpee cup and a mason jar last year in my dorm. I improvised and made a simple syrup using sugar packets I snuck out of the cafeteria and really hot tap water. Do a little research about how to make your favorite coffee and try to cut back on the expensive coffee you by from the campus coffee bar.

7. Make use of school activities.

Every year you pay a pretty high tuition fee, but not all of that goes to paying for classes. Universities spend a whole lot of money on campus activities ranging from movie nights to culture fairs. Take advantage of these opportunities that are already paid for. Instead of spending $25 on a movie ticket and popcorn, go see the movie being played by the office of student activities. If something really fun is being sponsored by the school, you usually pay nothing or a drastically reduced price. Get a bunch of friends and make it a really fun night. Fun doesn't have to cost an arm and a leg.

8. Open up a checking account to cut down on ATM fees.

Most campuses have one or two ATMs on campus. If the ATM doesn't belong to your bank, the fees can quickly add up with each withdrawal. These fees can be eliminated by opening a free checking account at the bank your university caters to. You may even get a little extra money in a sign up bonus. This year I got an extra $150 from Chase for setting up direct deposit into my new account and now I will not be charged fees at the campus ATM or at the grocery store. There may even be special student deals to help you out even more. It doesn't hurt to look into the possibility of opening an account.

9. Make a budget ... but stick to it.

Your money is a finite resource. To make sure you have enough to spend in areas that are important to you, make a budget. Know what you are willing to spend on eating out, activities, groceries, clothing and gifts. Before you go shopping or out to eat you will already have an idea of what you are willing to spend. You don't have to order the cheapest thing on the menu, but maybe you will opt to skip the appetizer. An Excel spreadsheet isn't that hard to make (it will even do the calculations for you).