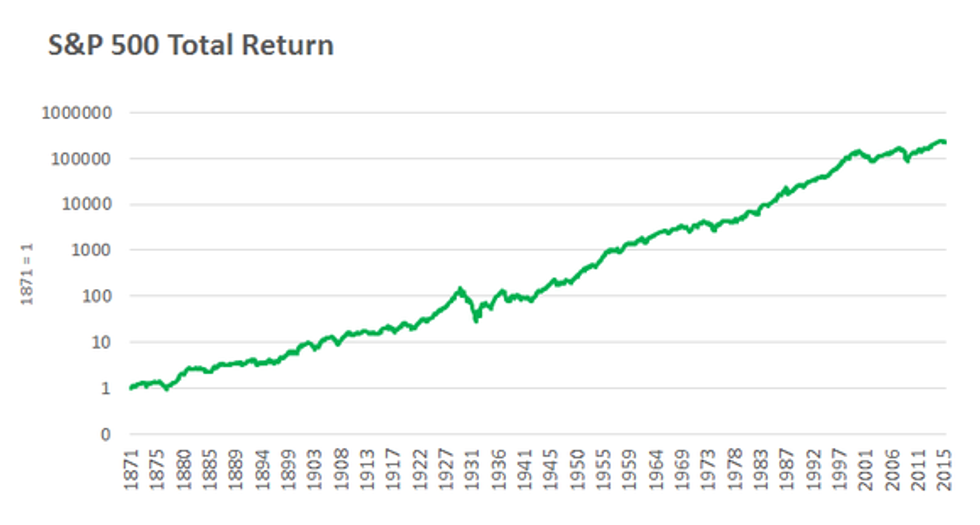

Before we begin let me show you the most powerful graph of all time...

*The S&P represents the largest 500 companies in the United States

I pulled that image from an article titled “Investing is a Fascinating Business” by one of my favorite financial columnists Morgan Housel. What I like about Morgan’s writing is that he puts finance and economics into simple and engaging terms. That image is so un-fascinating that it IS fascinating. That graph essentially answers the all the questions that smart people in suits in skyscrapers across the world are trying to answer: Stocks go up. Okay maybe that is a bit of an oversimplification but that graph is the absolute essence of finance. Because that graph always goes up there are skyscrapers surrounding Wall Street. A lot of people view the stock market as dangerous or think it’s practically gambling, but the reason there are big buildings in New York is not the same reason there are big buildings in Las Vegas. In Las Vegas the odds are stacked against you, and believe it or not, on Wall Street the odds are stacked in your favor. Las Vegas builds buildings from your negligence to lose money, Wall Street builds buildings from your negligence not to share in the wealth of the stock market.

People are generally apprehensive about the stock market, they think it is complex and shrouded in mystery that is beyond them. Much of that feeling I believe has been put forth by the financial industry themselves. Financial professionals wear fancy suits and use fancy terms that convey a feeling that they can handle your money better than you can, and then collect their management fees. I like the way Warren Buffet put it: “Wall Street is the only place that people ride to in a Rolls-Royce to get advice from those who take the subway.” Our graph above portrays is the average 9-10 percent return per year of the stock market. Now, what if I told you that 86 percent of managed mutual funds actually do worse than the market average?

Peter Lynch, one of the most successful mutual fund managers of all time, whose returns totaled 30 percent from 1978-1990 wrote in his classic book “One up on Wall Street:”

“I am supposed to share the secrets of my success as a professional stock market investor, but rule #1 is stop listening to professionals. Twenty years in the business has convinced me that any normal person using the customary three percent of their brain power can pick stocks as well if not better than the average Wall Street expert.”

If that is not straight out of the horse’s mouth, I don’t know what is. Before you read any book on investing you should read "One up on Wall Street." Lynch believes in a very simple investing strategy for personal investors like you and me. Buy what you know. For example, I am sure many of the people reading this drink coffee. Let’s be optimistic and say you only started drinking coffee at 16. I am 20, and If I invested in Starbucks exactly four years ago the day I am writing this I would have made 124 percent, a Peter Lynch level 31 percent return a year. My Amazon account tells me that I first created my Amazon Prime account in 2012. I was a junior in high school and I realized how awesome Amazon Prime was and bought it for myself. Now If I were to have bought the stock then… okay, let me do the calculation…I know this will be painful… I would have made 216 percent! Four years ago when I realized how awesome Amazon was the stock was trading at $254, today it is $805 a share. WOW.

Okay, well let’s say you don’t find the next Amazon or Starbucks. If you were to just buy an Index fund that tracks the S&P 500 and get 9-10 percent interest (basically buying a stock with a piece of each of the top 500 companies in the US in it) let’s see what would happen to your money. Now it is time to show you the second most powerful graph of all time.

This graph represents the power of compound interest and the power of stocks vs other investments. If you were able to invest just $1,200 a year, by year 40 your total investment of 48,000 would be worth about a half of a Million dollars. Remember, that is just If you were able to make average returns on the stock market. That is powerful. Einstein is quoted as saying “compound interest is the eighth wonder of the world.”

Now that you have an understanding of the value of investing let's run through some of the basics.

What is a Stock?

A share of a stock is essentially a slice of ownership in a company. Every stock has a ticker symbol that identifies it. For example, Chipotle’s is CMG and Apple’s is AAPL. As a shareholder, you technically own a small sliver of everything the company owns. As an owner, you are entitled to your share of the company's earnings as well as any voting rights attached to the stock based on how much stock you own. You can make money off a stock when the company becomes more valuable and the price of owning part of the company rises. Stocks also sometimes pay dividends (cash) directly to you. This comes in payments generally worth (.5-3 percent) of the price of the stock.

It is important to note that how much each share costs is not indicative of the performance of the company; it is how big each portion or share of the pie is cut. For example, Chipotle’s stock price as I am writing this is $408 and Disney's is $100. Chipotle’s “Market Cap” (the collection of how much every share is worth- essentially the value of the company) is 11.5 Billion and Disney is 162 Billion. Disney is just cut into smaller shares.

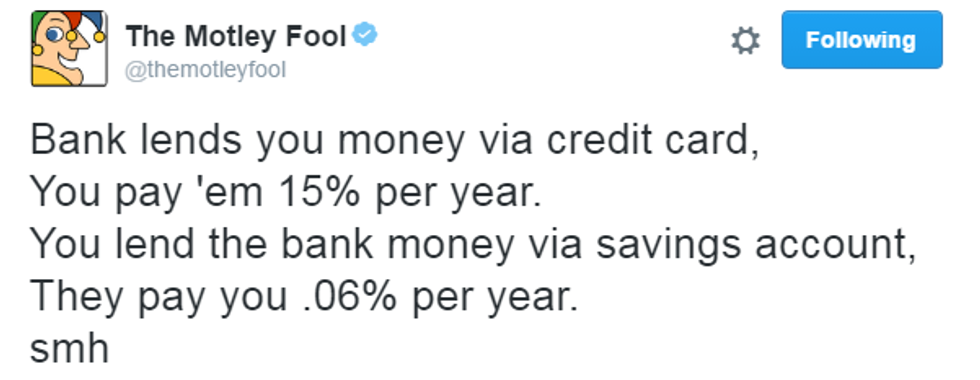

Interest Rates

If you have ever heard anything about interest rates on the news this refers to how the Federal Reserve changes how expensive it is to borrow money. I won’t go into much detail, but right now it is dirt cheap. Big banks and institutions can borrow money at very lower interest rates, which is supposed to boost the economy. This is the reason you get a .05 interest rate on your savings account at the bank-- it's worthless. What low-interest rates encourage is investment in stocks (the fancy term is equities), where you can actually get those 8,9,10 percent returns or even much greater. In our current interest rate environment, it is even more favorable to invest in equities (Stocks) than in fixed-income securities (another Wall St. term meaning bonds, and money market accounts like savings accounts)

How do I know If buying stocks is right for me?

Never invest money you can’t afford to lose is always the maxim. If you need to money to pay bills, don’t invest it! If you have a couple thousand dollars or even few hundred in a bank account getting .02 percent interest, you may want to think about investing. Remember this is not gambling! This is being financially responsible and giving you incentive to save your money so it can work for you.

Diversification:

Owning multiple stocks is less risky than own just a few. If you are just starting out, and depending on your risk tolerance it is perfectly okay to just own a few stocks. The safest and often times best investment is simply buying an S&P 500 index fund that mimics that market. Ticker Symbol: SPY. You are essentially owning a piece of the economy, and as the first graph shows it always goes up over time. SPY is instant diversification.

Brokerages

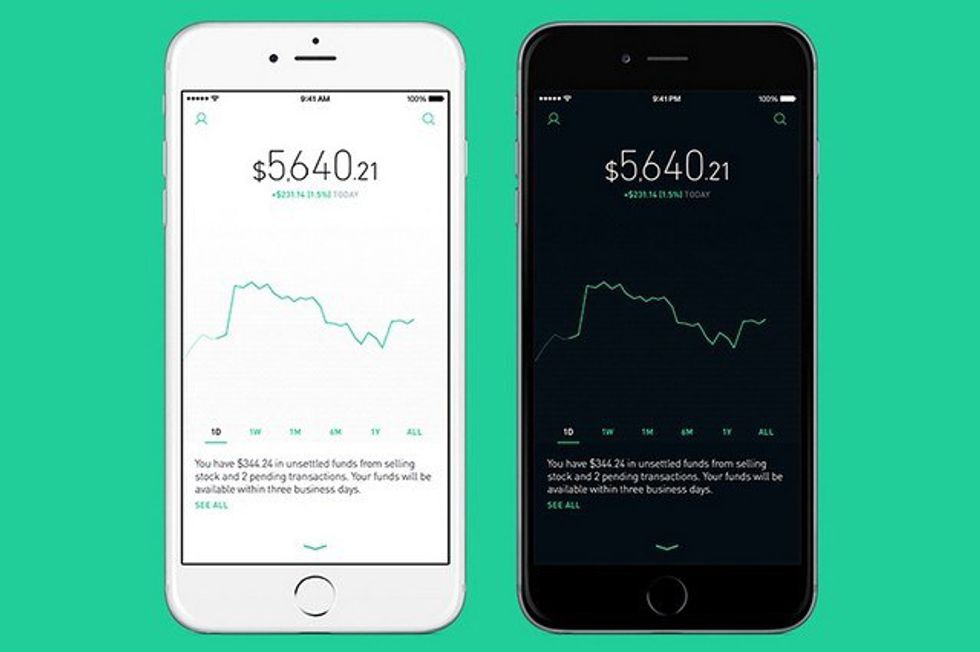

Before about the late 1990s you had to have a stock broker to buy stocks and they charged hefty fees. In the late 1990s companies like TD Ameritrade and E*TRADE and showed up and reduced trading fees to about $10 a trade. This significantly helped the personal investor gain ground on the Wall St. insider. Just recently has Robinhood come out. Robinhood is 100 percent free. It may not offer the bells as whistles as another broker but it is the easiest to understand and does not cost anything to trade-- it’s perfect for beginning investors with not a lot of money. Makes sense why it's called Robinhood right? Robinhood the character fights against the rich and in this case opens up a world in which anyone can make money like the rich.

What Stock Should I Buy?

Well, this is the million-dollar question. To keep it simple and safe, buy large companies with good management that are not going away anytime soon. Over the past couple years, some of the best performers have been the largest companies. You may hear about the FANG stocks on the news – Facebook, Apple, Netflix, and Google, those stocks the past couple years have grown so large and done so well they got their own acronym. Investing in those companies may seem so obvious that people tend to think it is not a good idea. Peter Lynch in “One up on Wall Street” described how “people seem to be comfortable investing in things they don’t know anything about.” Remember his message. Buy what you know and do your research. If you are comfortable, you can start to look into smaller companies with more growth potential. It all depends on your tolerance for risk, with that said…

NEVER BUY PENNY STOCKS. Penny stocks are companies who shares are worth a few cents, they are usually very small, very volatile, and may go out of business. Investing in penny stocks is in fact gambling.

There are three major types of equity investments

Stocks- Individual ownership in companies

ETFs (Exchange Traded Funds) – Buying a sector of stocks. Made by companies like Vanguard. For example, you can buy an ETF that covers a sector like Consumer Staples which is made up of companies like Coca-Cola, Proctor & Gamble, and Walmart. The most popular is simply an S&P 500 index fund which is like buying a piece of each of the largest companies in the US.

Mutual Funds – Funds actively managed by a mutual fund manager. The manager will invest your money for you and pick the stocks that make up the fund. There is often times decent seized fee associated with it.

Alright, let’s do it. How do I buy a stock? Step by step.

I want to show you exactly how to buy a stock because it is so much easier than you may think. I read books on investing before I even knew how to buy a stock. Don't be embarrassed if this seems simple because I didn't know either. For this example, we are going to exclusively use Robinhood because it is easy, on your phone, and 100 percent FREE.

1. Go you application store on your phone and download “Robinhood - Free Stock Trading”

2. Fill out the application to open an account Note: you will need your social security number and your bank routing number and account number.

3. Once you have set up your account you can search stocks by their tickers and view their stock performance chart

4. If you want to buy a stock, you simply hit “buy” and can enter in how many shares you want. The market is open weekdays 9:30-4:00 ET.

5. You can also change the order type. It is a “Market Order” by default which means when you buy the stock it will buy it at its current market price. If you click “order types” at the top right, you can change the type of order. If you chose “limit order” you can choose the price, you want to buy the stock at. So If the stock is at 408 you can type 400 and when the stock gets to 400 it will automatically buy the stock. This resets at the end of every day unless you change the “Time in Force” to “Good till Cancel” in which case it will never expire.

6. And once you have done that… Congratulations you have bought you first stock and are now a part owner of a company.

Quick word on Bulls and Bears

In finance speak, when someone is bullish they believe the market or a stock will go up. If they are bearish they believe the market will go down. "For reasons I have never understood, people like to hear that the world is going to hell," said historian Deirdre N. McCloskey to the New York Times. The media and many people you come across tend to be pessimistic about the stock market, and a lot of times that pessimism sounds smart. While I encourage you to always do your due process about picking investments, there will be bears in your life that may lead you astray. You will make mistakes investing, learn from them, but don't let the bears keep you from hoping on the bull that is the US Stock Market.

I have a lot to say about investing... for further reading and stock picks you can check out this Public Google Doc called Troy's Extra Stock Picks, Readings & Resources that I will update with cool stuff.