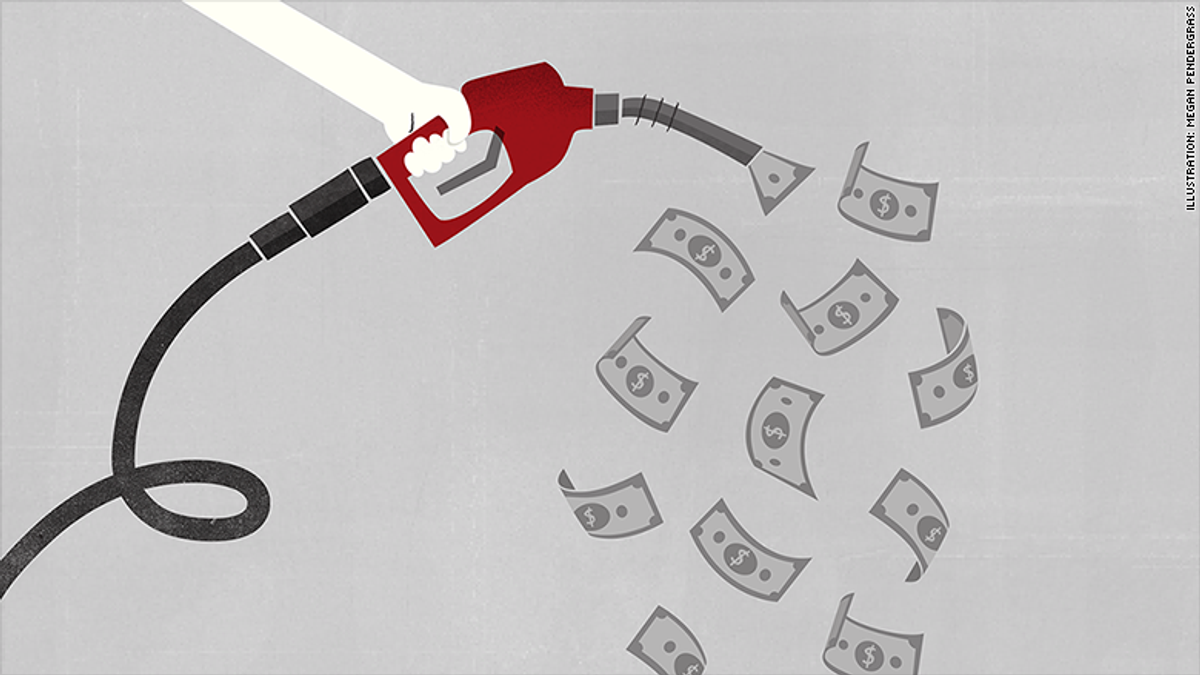

On July 1, the Michigan Senate passed a roads plan that might raise the revenues needed to repair the state’s roads and infrastructure, but the proposed plan may result in unforeseen consequences. Here’s the breakdown for those of you who drive and pay for your own gas:

The Plan

In a tie-breaking vote by Lt. Gov. Brian Calley, the Senate passed a 15-cent hike in the state’s gas tax to help raise $1.4 billion to $1.5 billion annually to fix Michigan’s deteriorating roads. It passed 20-19, with 19 Republicans and one Democrat voting for the bill and 10 Democrats and nine Republicans voting against it.

Under the plan, Michigan’s current 19-cent per gallon tax on gasoline would increase to 24 cents in October 2015, 29 cents in January 2016, and a final 34 cents in January 2017. Also, it would more than double the current 15-cent tax on diesel. Phased in over three years, the plan would raise both the gasoline and diesel tax to 34 cents per gallon. The rates would be adjusted annually to rise with inflation.

Once the 6 percent sales tax is added — which doesn’t go toward fixing roads — Michigan motorists would be paying 66.5 cents per gallon in state taxes at the pump in 2017 based on today's prices.

The revenue from this gas tax, along with income tax revenue diverted from other programs, would raise the proposed $1.4 billion each year. The plan earmarked a portion of general fund revenue for roads and would force future cuts in other areas of the budget. The requirement stipulates that $350 million from income tax revenues be shifted to roads in the 2016-2017 fiscal year and $700 million in each consecutive year.

Increased registration fees for hybrid and electric vehicles also passed.

No votes were taken on the elimination of the Earned Income Tax Credit (EITC) for low-income families (more on this later).

Opposition To The Plan

Democrats and Republicans alike voted against the proposed gas tax plan, noting its burden on the middle and low classes.

“We cannot fill potholes on the backs of working families and the working poor,” said Senator Curtis Hertel, D-East Lansing, in an interview. “I want to fix the roads as much as all of you. I’m more than willing to sit down and find a solution.”

Other opponents of the bill voted against the gas tax increase, arguing that the roads can be repaired without raising taxes. Senator Pat Colbeck, R-Canton, used this as his reasoning:

“Regrettably, the Senate ignored the Proposal 1 election results in which 80 percent of voters rejected a tax increase and chose the ‘road most traveled’ by increasing the tax burden on our families,” he said in a statement.

Michigan Proposal 1, a statewide ballot proposal that would have raised taxes by almost $2 billion to fund road repairs and other issues with transportation and infrastructure, was widely rejected by voters on May 5.

Most arguments against Proposal 1 are the same as the ones against the gas tax hike passed by the Senate. It is feared that the change in taxes will fall largely on the working class and poor families who cannot afford tax increases.

Support For The Plan

The Republican-led Senate supported the gas tax hike plan in order to take a step toward better infrastructure.

"We're never comfortable going all that way, but I think what we're comfortable with is this is a great step forward, and there's a lot of new revenue for transportation, and we're willing to look at whatever they bring," Dick Posthumus, Rick Snyder's senior adviser for legislative affairs, told reporters.

Calley, who broke the tie in the Senate, further explained his decision to vote in favor of the plan.

"It was important that we move the package forward so we can start the final negotiations between the House and the Senate and the governor,” he said after the decision. “At the end of the day, I want to get our roads fixed."

Questions Raised

You may ask, “Which programs are losing funding? How much money from each? Will this lead to financial problems in other departments?”

“I can tell you it’s not an across the board cut,” said Senate Majority Leader Arlan Meekhof, R-West Olive, in a statement, “but we will be looking at the highest priorities we believe the citizens of Michigan have, and those are the things we’re going to fund.” He went on to state that “it is simply unrealistic to assume we can adequately fund our roads and bridges without new revenue.”

In sum, Meekhof declined to discuss any specific budget cuts, remarking that those decisions will be made during the appropriations process.

Even Michigan Governor Rick Snyder’s chief lobbyist expressed concern about having to cut $700 million elsewhere from the state’s $10 billion general fund.

What’s The Deal With EITC?

After the rejection of Proposal 1, eliminating the EITC is a part of the GOP House plan to raise money to fix roads and bridges. It was a vital part of the House roads plan passed in June.

The EITC is a refundable tax credit for working low-income households with annual incomes of up to $34,000. The federal tax credit is equal to a percentage of earned income, based on the number of children in the household. The state EITC is set at 6 percent of what a state taxpayer is allowed to claim under the federal EITC.

Rep. Jeff Farrington, R-Utica, who is the sponsor of House Bill 4609 to eliminate the EITC, calls it the “perfect program to target ... if you want to cut back on fraud and abuse.”

To counter this, CEO of the Michigan League for Public Policy Gilda Jacobs testified that child poverty remains at “record-high levels” in Michigan and that the credit improves infant health, helps children perform better in school, and reduces the need for other forms of public assistance.

“[Eliminating the EITC] would be a tax hike on 820,000 working families who are raising 1 million children here in Michigan,” she stated in an interview. “It would basically increase poverty for thousands of Michiganders.

The Senate has yet to vote on the proposal for its elimination.

What This Plan Means For You

As a college student from a lower-middle class background, I know that I cannot afford tax increases. Tuition for colleges in Michigan is rising, and, although road repairs are necessary, the proposed solutions place burdens on taxpayers who cannot afford to pay more at the pump (or anywhere else for that matter).

Considering the GOP-controlled Legislature has cut corporate taxes by more than $2 billion each year since 2011, solutions exist to reallocate funds without targeting the lower and middle working classes. Say, tax the One Percenters and cap their continually increasing salaries.

Michigan’s roads need to be fixed. No one can deny that, but repairs shouldn’t come at the expense of working, low-income Americans with the least ability to pay.

So what’s next? The bill heads to the House for approval. The final vote on a gas tax increase could come the week of July 13.

Going to the cinema alone is good for your mental health, says science

Going to the cinema alone is good for your mental health, says science

women in street dancing

Photo by

women in street dancing

Photo by  man and woman standing in front of louver door

Photo by

man and woman standing in front of louver door

Photo by  man in black t-shirt holding coca cola bottle

Photo by

man in black t-shirt holding coca cola bottle

Photo by  red and white coca cola signage

Photo by

red and white coca cola signage

Photo by  man holding luggage photo

Photo by

man holding luggage photo

Photo by  topless boy in blue denim jeans riding red bicycle during daytime

Photo by

topless boy in blue denim jeans riding red bicycle during daytime

Photo by  trust spelled with wooden letter blocks on a table

Photo by

trust spelled with wooden letter blocks on a table

Photo by  Everyone is Welcome signage

Photo by

Everyone is Welcome signage

Photo by  man with cap and background with red and pink wall l

Photo by

man with cap and background with red and pink wall l

Photo by  difficult roads lead to beautiful destinations desk decor

Photo by

difficult roads lead to beautiful destinations desk decor

Photo by  photography of woman pointing her finger near an man

Photo by

photography of woman pointing her finger near an man

Photo by  closeup photography of woman smiling

Photo by

closeup photography of woman smiling

Photo by  a man doing a trick on a skateboard

Photo by

a man doing a trick on a skateboard

Photo by  two men

two men  running man on bridge

Photo by

running man on bridge

Photo by  orange white and black bag

Photo by

orange white and black bag

Photo by  girl sitting on gray rocks

Photo by

girl sitting on gray rocks

Photo by  assorted-color painted wall with painting materials

Photo by

assorted-color painted wall with painting materials

Photo by  three women sitting on brown wooden bench

Photo by

three women sitting on brown wooden bench

Photo by

Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by

people sitting on chair in front of computer

people sitting on chair in front of computer