I love money. I am sure in most instances, everyone does. It got to the point where I had three jobs to realize JUST how much I really loved my money and cash flow. I found myself to be 100% exhausted all the time, but hey, I had cash and money in my bank. Why complain?

Up until this summer, I was very fortunate in my spending for a college student. Of course I have loans and bills, but for the most part, if I wanted something, I bought it. I worked hard for my money and at this point in my life, I am mostly guilt-free over my purchases. This of course was until I ran into the “I am in debt and my bank account is negative” situation.

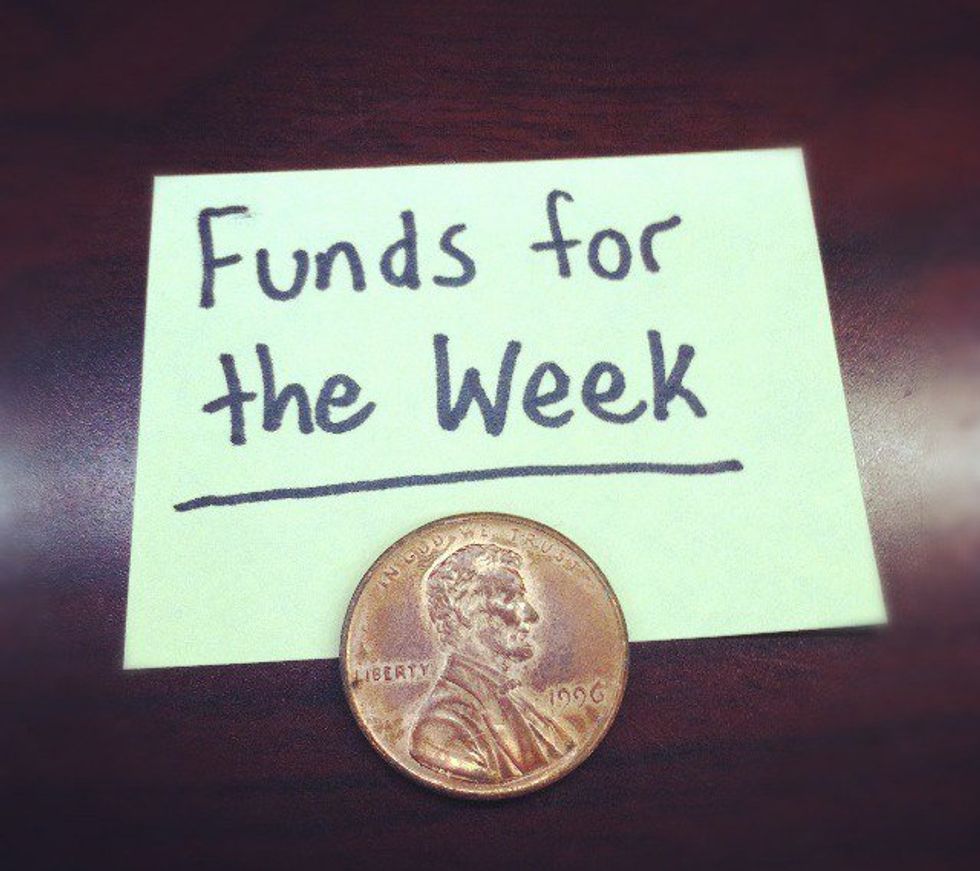

You see, I had to pay for a summer class which was a whopping $1200. On top of that, I had to spend $100 more for an online course code. How ridiculous. With the due date on these payments a paycheck earlier than I expected, I found myself absolutely broke. It was truly torture.

For someone that is used to picking up something and purchasing it without much thought on a budget, this ruined me. When I say ruined, it completely changed my perspective on how to budget my money (for now). I learned a few things about myself during this brutal two weeks of no spending.

I learned how much I think about Starbucks and their Very Berry Refresher.

I learned how even the 2/$3 Gatorades are a little steep in price.

I was reminded that only putting $5 in your gas tank is a little awkward.

I learned that eating out actually is really expensive and maybe I should indeed just eat a turkey sandwich.

I learned just how far I could stretch my gas tank and which hills I should coast down.

I learned how to say “No” to shopping.

I learned that my friends enjoy eating out just as much as I do. (Three friends paid for my meals during those brutal two weeks).

I learned to never get too comfortable in expenses.

I learned that dad's bank account can save the day and loan me money.

I learned that mom's bank account will too.

I learned that Justfab.com has a pointless VIP group and I should definitely cancel it. $40 a month is too much.

I learned that an overdraft fee is $35.

I also learned that a savings account fee is only $5.

I suppose it is necessary for everyone to be absolutely broke once in their life to truly see the meaning of money. While I am back in action with my obnoxious spending on meals, clothes, and art supplies, I would have to say I do feel a little more cautious when it comes to throwing money at something I don't really need. It's nice to know my parents will always have my back when I'm drowning in my big kid bills. It's nice to have friends that love going out to eat so much that they're willing to pay for my food, too.

But now that I've gotten myself out of that treacherous hole called debt, I hope to never return to that scary, awful, dark place.