Do you know who is Mount Holyoke's Chair of the Board of Trustees?

Do you know who controls the endowment?

Curious about the recent tuition hike?

These questions aim to inspire discourse on the finance logistics at Mount Holyoke.

With just over 2100 students, Mount Holyoke's endowment stands at $713.5 million. As any college goer can attest to, colleges, especially private corporations like Mount Holyoke, sell us the idea that attending their institution will change your life. Colleges seek to create the next generation of problem-solvers of this world. They tell each of their graduating classes that they are the vanguard of social justice change.

This is certainly not untrue.

However, Mount Holyoke is also faced with another falsity. Contrary to the claims made by Mount Holyoke's finance committees and the Board of Trustees, the endowment is political. When Mount Holyoke profited from South African apartheid in the 1980s, it condoned the regime's segregation and denial of civil liberties. Today when Mount Holyoke profits from companies like ExxonMobil, which ventures into the Arctic to drill for natural gas, it contravenes environmental activism. Mount Holyoke has a choice in what industry it invests. Wherever Mount Holyoke profits, it sanctions that industry as not only economically viable, but also socially acceptable.

Below, I provide a brief summary of an endowment education workshop Mount Holyoke Climate Justice Coalition hosted in Spring 2016. Since 2012, MHCJC has run the fossil fuel divestment campaign at Mount Holyoke. Divestment is removing one's stocks from a particular industry. The complete workshop is made available by Responsible Endowments Coalition (REC).

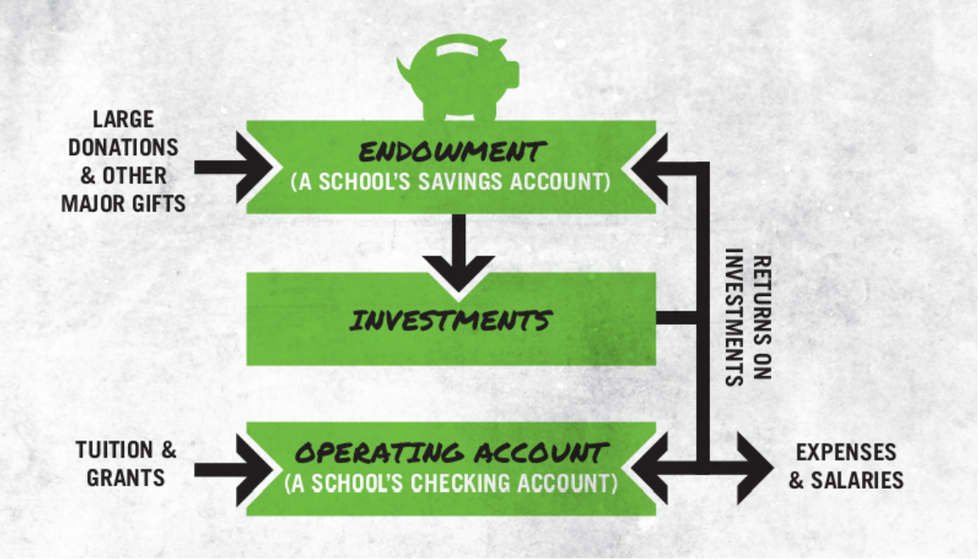

Most schools have two pots of money: the endowment and an operating account. The endowment functions as a savings account made of alumnae donations and returns on investments. The operating account serves as a checking account, comprised of tuition money and any grants Mount Holyoke may receive. The operating account is 5% of the endowment.

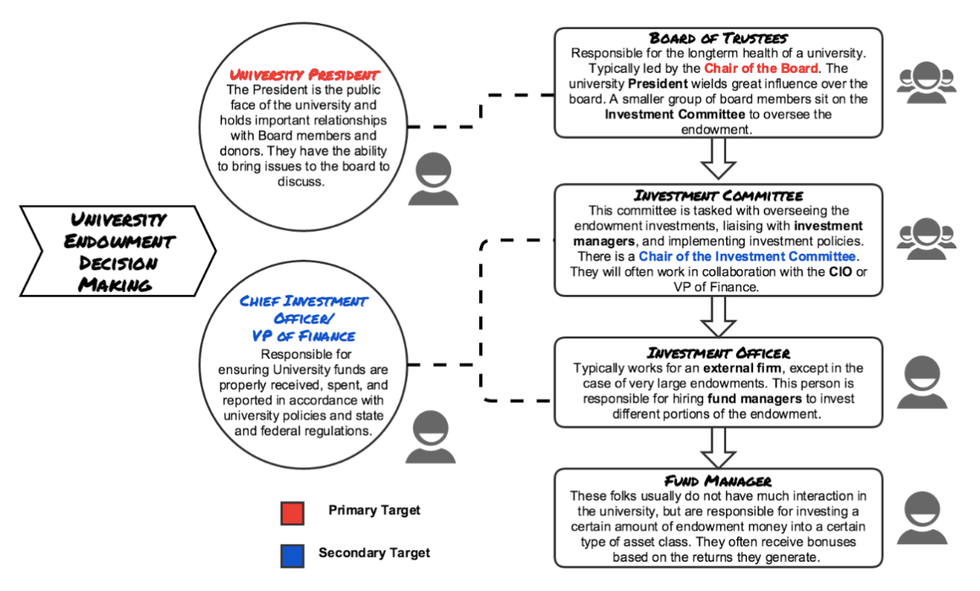

The Board has the final say over the endowment. To my knowledge, only the Young Alumnae Trustee position requires student votes. Furthermore, the President has no decision-making influence over the endowment. In 2015, Mount Holyoke appointed a new Chair to the Board, Barbara M. Baumann '77. Baumann has held many high level positions at Amoco Corporation, previously known as Standard Oil Company, which John D. Rockefeller founded. Since 2003, Baumann has served as President of Cross Creek Energy, a consulting firm specializing in oil and gas exploration.

The Rockefeller Brothers Fund has divested from fossil fuels.

In Spring 2015, I sat on an ad-hoc committee commissioned by the Chair of the Faculty Planning and Budget Committee, Professor James Harold. After several months of research and discussion, the ad-hoc committee came out in full support of divestment.

If we are to realize change, we must begin with education and transparency.