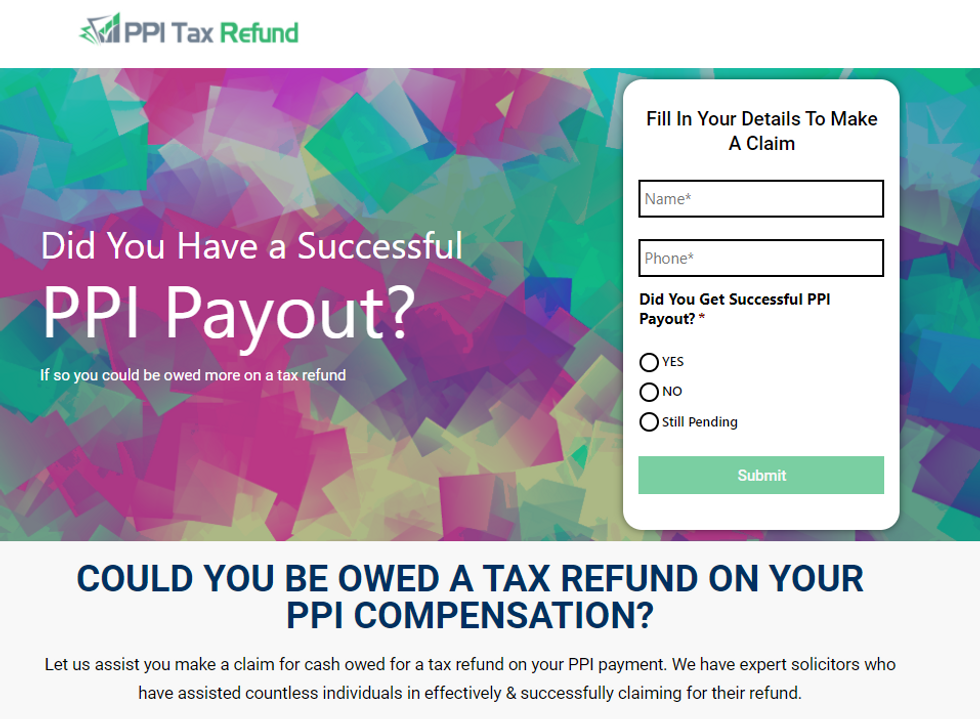

In this guide, we take an appearance at how much money you might be able to declare back from HMRC.

Why can I claim back PPI tax?

On 6 April 2016, the government introduced the Personal Cost savings Allowance, which permits customers to earn approximately ₤ 1,000 interest every year on their savings, tax-free. Nevertheless, due to guidelines introduced by HMRC, 20% tax has still been automatically deducted from all PPI statutory interest payments.

So, as PPI is taxed at the time of payment, if you have actually received any PPI pay-outs since 2016, a tax refund may be due to you.

PPI tax refund estimation

So, just how much PPI tax refund might I be entitled to?

Generally, the statutory interest component of the PPI compensation pay-out that you got was taxed at the base rate of 20%. So, for each ₤ 1000 refund of the statutory interest that you were paid, ₤ 200 was deducted in tax.

Nevertheless, the amount of tax that consumers are entitled to recover differs on a number of things, and the form-filling that's needed to make a claim can be somewhat challenging.

Because of that, we recommend that you let us help you to navigate the minefield of all those complex forms. You can begin the procedure to recover the cash that you're owed by contacting us by means of our online website today. The protected, paper-free service takes simply a number of minutes to finish, it's totally no win, no fee, and we could get you're the refund you deserve in as little as six weeks. It's a no-brainer!

Tax recover entitlement

Because the Personal Savings Allowance wasn't presented up until 6 April 2016, any PPI refunds that were paid out prior to that date are not eligible for a tax refund.

Nevertheless, even if you took out a PPI policy as far back as 1980, supplied that you received the refund after 5 April 2016, you may have the ability to reclaim the tax that was automatically deducted on the statutory interest that you were granted.

I wasn't a taxpayer. Can I still declare?

If you weren't a taxpayer in the year that you received the PPI pay-out, unless the statutory interest payment that you got pressed you over the tax threshold, you are entitled to declare all of the tax back.

I'm a greater rate taxpayer, can I make a claim?

No, unfortunately, those making in excess of ₤ 150,000 are not entitled to the Personal Cost Savings Allowance. Therefore, you can't claim the tax back that you paid on your statutory interest payment.

If you were in the higher-rate tax bracket when you received your PPI refund pay-out, the tax rate you need to have paid was 40%, which you ought to have done through self-assessment. If you didn't do that, you need to notify HMRC.

The clock is ticking!

Presently, you are just entitled to reclaim PPI tax four years retrospectively, consisting of the present year. For the year 2020/21, you can't go back any even more than the 2016/2017 tax year. If you do not act then there's an opportunity you might lose any excess tax paid forever!

Do not wait till next year!

Start our online reclaim procedure today to check if you can make a claim. Don't run out of time to get the tax back that you are owed!

women in street dancing

Photo by

women in street dancing

Photo by  man and woman standing in front of louver door

Photo by

man and woman standing in front of louver door

Photo by  man in black t-shirt holding coca cola bottle

Photo by

man in black t-shirt holding coca cola bottle

Photo by  red and white coca cola signage

Photo by

red and white coca cola signage

Photo by  man holding luggage photo

Photo by

man holding luggage photo

Photo by  topless boy in blue denim jeans riding red bicycle during daytime

Photo by

topless boy in blue denim jeans riding red bicycle during daytime

Photo by  trust spelled with wooden letter blocks on a table

Photo by

trust spelled with wooden letter blocks on a table

Photo by  Everyone is Welcome signage

Photo by

Everyone is Welcome signage

Photo by  man with cap and background with red and pink wall l

Photo by

man with cap and background with red and pink wall l

Photo by  difficult roads lead to beautiful destinations desk decor

Photo by

difficult roads lead to beautiful destinations desk decor

Photo by  photography of woman pointing her finger near an man

Photo by

photography of woman pointing her finger near an man

Photo by  closeup photography of woman smiling

Photo by

closeup photography of woman smiling

Photo by  a man doing a trick on a skateboard

Photo by

a man doing a trick on a skateboard

Photo by  two men

two men  running man on bridge

Photo by

running man on bridge

Photo by  orange white and black bag

Photo by

orange white and black bag

Photo by  girl sitting on gray rocks

Photo by

girl sitting on gray rocks

Photo by  assorted-color painted wall with painting materials

Photo by

assorted-color painted wall with painting materials

Photo by  three women sitting on brown wooden bench

Photo by

three women sitting on brown wooden bench

Photo by

Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by

people sitting on chair in front of computer

people sitting on chair in front of computer

all stars lol GIF by Lifetime

all stars lol GIF by Lifetime two women talking while looking at laptop computerPhoto by

two women talking while looking at laptop computerPhoto by  shallow focus photography of two boys doing wacky facesPhoto by

shallow focus photography of two boys doing wacky facesPhoto by  happy birthday balloons with happy birthday textPhoto by

happy birthday balloons with happy birthday textPhoto by  itty-bitty living space." | The Genie shows Aladdin how… | Flickr

itty-bitty living space." | The Genie shows Aladdin how… | Flickr shallow focus photography of dog and catPhoto by

shallow focus photography of dog and catPhoto by  yellow Volkswagen van on roadPhoto by

yellow Volkswagen van on roadPhoto by  orange i have a crush on you neon light signagePhoto by

orange i have a crush on you neon light signagePhoto by  5 Tattoos Artist That Will Make You Want A Tattoo

5 Tattoos Artist That Will Make You Want A Tattoo woman biting pencil while sitting on chair in front of computer during daytimePhoto by

woman biting pencil while sitting on chair in front of computer during daytimePhoto by  a scrabbled wooden block spelling the word prizePhoto by

a scrabbled wooden block spelling the word prizePhoto by

StableDiffusion

StableDiffusion

StableDiffusion

StableDiffusion

StableDiffusion

StableDiffusion