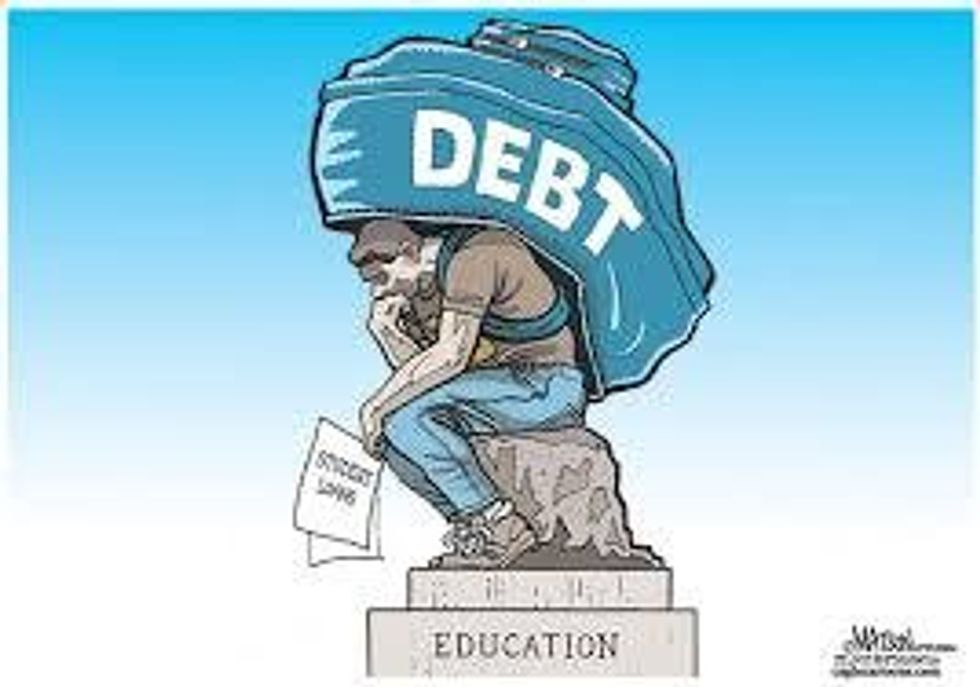

Graduating college should be something to be proud of in our world. You spent the last four years of your life dedicating yourself to becoming a qualified person in the work force. Unfortunately, for a lot of students in the United States, that dedication comes at a huge cost.

Student loan debt is an astronomically large problem in the U.S. According to the Institute for College Access and Success, 69 percent of seniors who graduated from public and non-profit schools in 2014 accumulated an average of $28,950 per borrower. Most loans have a six month "grace period," which means students don't have to start paying back their loans until six months after they graduate from college.

So how much would someone with $28,950 in student loan debt have to pay if they want to pay off their loans in 10 years? If you use this loan calculator to make the calculations, it comes out to be $333.16 per month.

That may not seem like a lot for student debt loan repayment. However, know that the average salary for an entry level position in the United States is $42,963. That makes the monthly income of an average adult with the average amount of student loan debt to be $3,580.25. Not bad, right? $3,580.25 minus $333.16 equals $3,247.09, plenty to live off for the month. But then there's rent, which on average is $905 per month, utilities ($149.83 per month), Internet ($49.29 per month), car payments ($483 per month), car insurance ($150 per month), food ($301 per month), clothing ($67.08 per month), a cell phone bill ($71 per month), credit card bills and health insurance costs. That $3,247.09 can be gone in a flash for those who are fresh out of college and obtain entry-level jobs.

All that math is accurate if you count a college graduate getting the average entry-level position—but what if they fall short of that entry-level salary? According to finaid.org, a person needs to make a minimum of $39,979.20 to pay back the average student loan debt of $28,950. For the college graduate who is only making $25,000 a year at an entry-level position, this spells out big trouble.

There are ways you can help make your student loan payments decrease, such as refinancing your student loan debt. However, this could mean that it would take longer to pay back your student loan debt.

Students graduating from college should not have this heavy burden on their backs as they start out their adult life. The early 20s are a crucial time in a person's life to start learning how to save and invest money. People learn their money habits during their 20s, and if they're scrambling for cash in their 20s, they'll be scrambling for most of their lives.

A possible solution to the student loan debt crisis that's plaguing America is to lower interest rates on student loans. The average interest rates on student loan debt ranges from 4 to 7 percent—but if certain banks borrow money, they can get a discounted interest rate on their loan. Is it really fair that a bank can receive a discounted interest rate on their loan that may be lower than the interest rate students students are paying?

No matter how it is done, the student debt crisis needs to be handled properly—and fast. The student debt in the United States has reached $1.2 trillion. That's a number this country cannot ignore anymore. Change needs to be made if this country does not want to see a generation of its people struggling to make ends meet for the rest of their lives.