We’ve all been involved in interviews that didn’t result in getting the job. It’s easy to look at the interview as a loss. It’s understandable that the time spent preparing for it can seem like a waste, but think about it – now you’re even more prepared for the next one. Here’s why:

- You know what kind of questions to expect. After having a few interviews, it becomes clear that there is a pattern to the questions that are asked. Of course it will vary by employer, but it helps to know potential interview questions ahead of time. Write questions and answers down from previous interviews in order to improve or extend on your answers in the future.

- You may be less nervous going into interviews. Whether it’s answering the phone or shaking a hand, these things only get easier with practice. Although it may be impossible to completely ease the nerves that come with the initial greeting of an interview, you may find that over time you feel more comfortable introducing yourself. Use each interview as a chance to work on your interpersonal skills and take notes after to review for the next time.

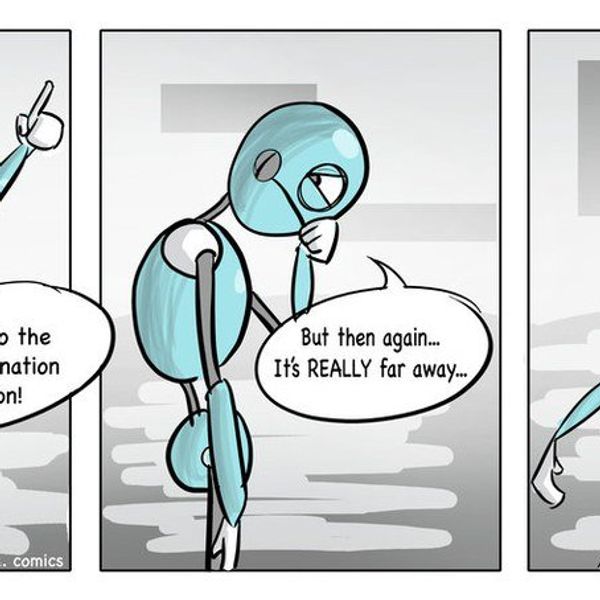

- You can start to recognize how you feel after each interview. I’ve heard it said many times that an interview is not just a company seeing if you’re a good fit. You have to see if the company is right for you as well. Notice how you’re feeling before, during, and after every interview. You’ll begin to notice the jobs you’re passionate about and ones you’re not necessarily excited about by comparing how you feel after the interviews. Did you hang up the phone and feel even more attached to the company? Or did you leave the office feeling confused? Don’t be afraid to address these feelings and compare them. Remember you are interviewing the company too.

- You’ll know what questions to ask. In every interview there is always a chance for you to ask questions. If at the first interview you didn’t have any questions, try to think of some for the next time. I like to ask the interviewer how they got started at the company. What position did they start in and why are they passionate about working there? This gives me some insight to the company culture and shows if there is room for growth. Come up with questions before each interview and be open to adding to them depending on where the conversation goes.

We all hope the end result of an interview is getting a job, but try to remember that every interview can be a positive learning experience, regardless of the outcome. Take notes after interviews and continue to go into every one with confidence and a positive attitude. The right company will come along eventually. Try to enjoy the process in the meantime!