Summer is at its end and the fall semester has just begun, this means a few things. First being that some of us have taken out more student loans to pay for the semester. Second is that a few of the lucky ones will be enjoying their first college-free semester but either way the woes of student loans float over our heads. There are currently over 43 million Americans that hold student debt. This is larger than 201 countries population, including our northern neighbor Canada by several million.

Below is a cheat sheet to understand the world of student loans and how to go about choosing the best repayment plan for you. If you are lucky, you may even qualify for your loan to be paid FOR YOU!

Subsidized vs Unsubsidized loans

This is where it can get a bit confusing. There are two different types of federal loans--direct subsidized and direct unsubsidized. Although they are very similar the difference between these two is very important. Subsidized loans are loans that the government pays the interest on while you are in and shortly after you finish school. Unsubsidized loans are loans that the interest is not being “subsidized” meaning there is accruing interest.

Federal Programs

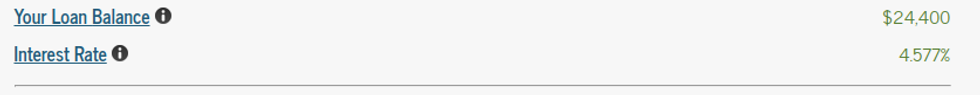

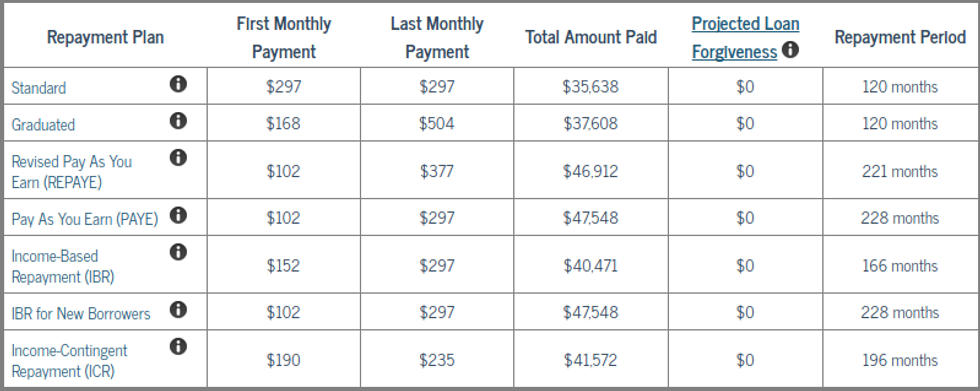

Now that we have some of the terminology out of the way let’s move on to federal programs loans. Student Loans is an online loan information source that has compiled a calculator that helps you better understand the world that is student loans. Below I calculated my pre-interest loan to help you get a better idea of the following federal programs.

Standard Repayment Plan

This is the standard plan that you will be enrolled in if you do not choose any other option. This is the most common repayment method that requires minimum payments of $50 for up to 10 years. This option has the lowest overall interest accruation but requires higher due payments.

Graduated Repayment Plan

This payment plan is very similar to the standard but works off of a graduated system. This is a 10 year plan where every two years the payment increases until the loan is paid off. This plan results in a slightly higher accrued interest rate. This program is good for anyone who assumes they will have a steadily increasing income.

Pay As You Earn / Revised Pay As You Earn (PAYE/REPAYE)

This payment plan is very different from the two previous plans. Under this plan monthly payments are capped at 10% of your income after taxes and deductions. Instead this payment plan is a 20 year payment plan which means you will pay higher interest in the long run. You will also have to prove financial hardship in order to partake in this program. Some of the pros to this program is that after 20 years the remaining amount may be excused. This is especially true for those who work in public service or teaching.

Income Based Repayment (IBR)

This payment plan is the second payment program that is based off of your income. Similar to the PAYE programs, to qualify you must prove financial hardship. Each year your payment plan will be readjusted but capped at 15% of your discretionary income and family size for up to 25 years. If you have a job in public service then there is a possibility after 10 years of ontime payments your loan can be forgiven. However if you do not send the needed information annual on time then you will be reverted back to the standard repayment plan.

Income-Contingent Payment (ICP)

This program is a bit more confusing, however it is very similar to the previous income based plans. What makes this plan a bit more complicated is that there are two methods for calculating payments. The first method is a capped amount of 20% of your monthly discretionary income. The second is a 12-year payment plan that is multiplied by a certain income percentage. The payment plan is determined by whichever is less. This plan is good for those who do not qualify for PAYE/REPAYE or IBR but will still result in a higher interest payment over the 12 years compared to 10.

*Loan Forgiveness Programs*

Teacher Loan Forgiveness

If you are a teacher than you may qualify for this program. To qualify you must be teaching full-time in a low-income school district for five consecutive years. If these requirements are met up to $17,500 may be forgiven. If you are interested in reading more check out Teacher Loan Forgiveness.

Public Service Loan Forgiveness

To qualify for this forgiveness program you must have a public service job. As as secondary requirement you must have made 120 loan payments. If both of these are met, then the remaining balance may be forgiven. This program can be used alongside with some but not all of the previous payment plans. To find out more go to Public Service Loan Forgiveness.

Perkins Loan Cancellation and Discharge

This program is for those who work in public service or are employed in certain occupations.

Some of these occupations include:

Volunteer in the Peace Corps

Teacher

Member of the U.S. armed forces

Nurse or medical technician

Law enforcement or corrections officer

Head Start worker

Child or family services worker

Professional provider of early intervention services

What makes this program different from prior forgiveness programs is that a percentage of the loan may be canceled for each year of service. These are all dependent on the career worked, but some will be fully forgiven while others have a cap on the percentage. For more information please visit Forgiveness-Cancellations.

*New York State Programs*

Get Off Your Feet (GOYF)

This is NYS newest forgiveness program that will pay up to 24 monthly payments for you. To qualify for this program you must also qualify for either PAYE/REPAYE or IBR.

If qualifications are met then a second set of qualifications must also be met:

-be a legal resident of NYS and have resided in NYS for 12 continuous months

-have graduated from a NYS high school or received a NYS high school equivalency diploma

-have earned an undergraduate degree from a college or university located in NYS in or after December 2014

-have earned no higher than a bachelor’s degree at the time of application

-apply for this program within two years of receiving an undergraduate degree.

-have a primary work location in NYS, if employed

-have an adjusted gross income of less than $50,000

-be current on all federal or NYS student loans

-be current on the repayment of any NYS award

These 24 payments will be based of the IBR or PAYE/REPAYE payment plan however you will be required to pay taxes on this amount. This program is perfect for those who have not found a sustainable career and are currently residing in New York. If you are interested in finding out more visit the Frequently Asked Questions section of https://www.hesc.ny.gov.

Following this guide should help you decide which is best for you, or at the very least have a better understanding of the world of student loans.