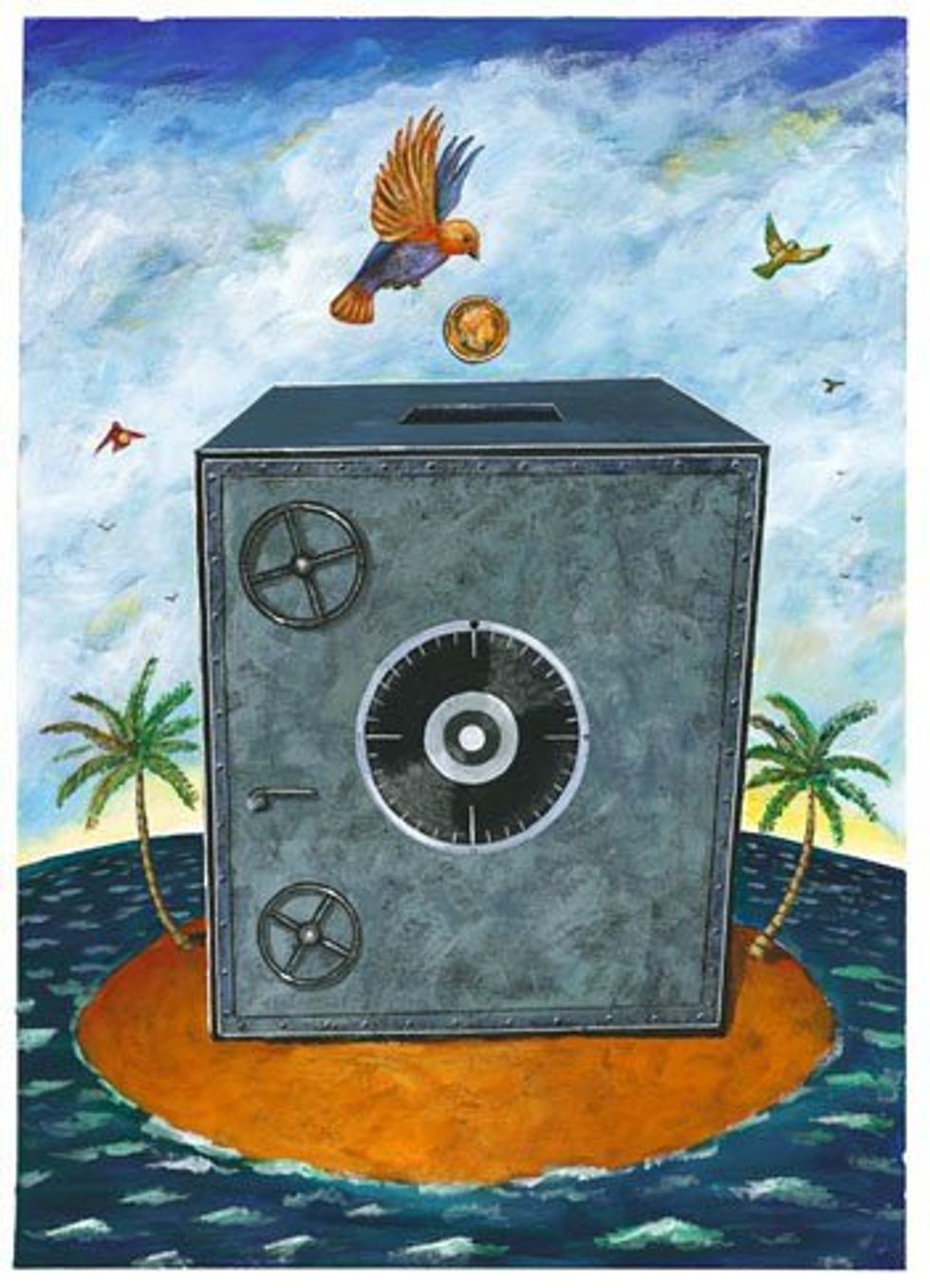

Growing up in the good ole U.S. of A, we all know that money is power. The majority of influential people we know about, look up to, and even try to emulate are the ones with the dough to actually buy the world. Even the people we don’t necessarily like (looking over at Kardashian and Trump) we still have to admit to a smidgen of respect for because they have acquired the American Dream. The American Dream meaning that they got rich as quick as they could of course. With the majority of us still struggling toward that dream and a small group of millionaires controlling the money flow, it’s become somewhat like the quest for the holy grail as people try to figure out the rich man’s secrets. Now, because of a John Doe from Germany leaking a couple hundred documents, the secret is out- offshore banking and shell companies.

What It All Means

According to International Man, offshore banking is basically getting “a bank account you have outside of your country of residence” but it’s a little more complicated than that. First off, it’s not illegal in the U.S. if done correctly, which I myself had no idea about. As long as the money offshore is accounted for during taxes, the whole thing is fine. What is not fine is when the money is shipped all over the world and no one at the IRS or the equivalent of it in other countries knows of its existence. It is also definitely not fine when the accounts are used for money laundering schemes, which means to do some illegal crap while pretending it’s legal(it’s a lot of business talk, bear with me). You get taxed or should get taxed no matter where you take the cash. Shell companies is a different concept from offshore banking. A shell company is “an inactive company used as a vehicle for various financial maneuvers or kept dormant for future use in some other capacity” according to Google. It can be used for normal reasons, like getting financing for other business linked to it, but it also can be used for tax evasions.

The Papers

So, knowing how offshore banking and shell companies should and should not be used, you can understand why regular folks would be mad to hear that rich people weren’t using these business tools right. The documents leaked, called the Panama Papers, were taken from a Panama law firm called Mossack Fonseca and given to German investigative reporter called Bastian Obermayer because the anonymous source need to “make these crimes public”. Within the information given, the names of over a hundred wealthy people, including names of world leaders like President Vladimir Putin of Russia, the prime ministers of Iceland and Pakistan, and the king of Saudi Arabia. Of course with around 140 names on the list, there is bound to be a few Americans. Do we get their names? Not as many as other places, because the moving of money to other countries is legal in America and nowhere else it seems. What we do get is the ability to speculate, which has Hillary Clinton in the hot seat at this point in her campaign.