The one unifying factor that all college students share is that we're all broke as a joke. However if you start becoming financially conscious now, you won't be drowning in too much debt by the time you graduate.

1. Student discounts!!!

One of the best perks of being a student is that companies realize your broke. You might be surprised to find out many of the stores you already shop at offer student discounts. Here's a link to a list of stores/websites that offer student discounts, http://www.thesimpledollar.com/60-awesome-student-.... (make sure to check out the student discount that spotify has to offer)

2. Put 3/4 of your paycheck into a bank account you can't get to easily

Whether this account be for your bills or just your savings, if its harder for you to get to then you're less likely to spend it.

3. If you're buying a more expensive item, use the 2 day rule.

Let's say your at Target and see this gorgeous lamp that you MUST have. Take a picture of it and go home. If in two days you still can't stop thinking about this great lamp then go ahead and get it. Most likely you'll end up forgetting about it, and save yourself 60$.

4. Impulse buys

I'm really bad about just buying things for no reason at all. A tactic I use is that I'll pick up the item and carry it with me all around the store. By the time I'm ready to check out I usually end up putting at least 1-2 items back, but for some reason just carrying around the item is just as satisfying as buying it.

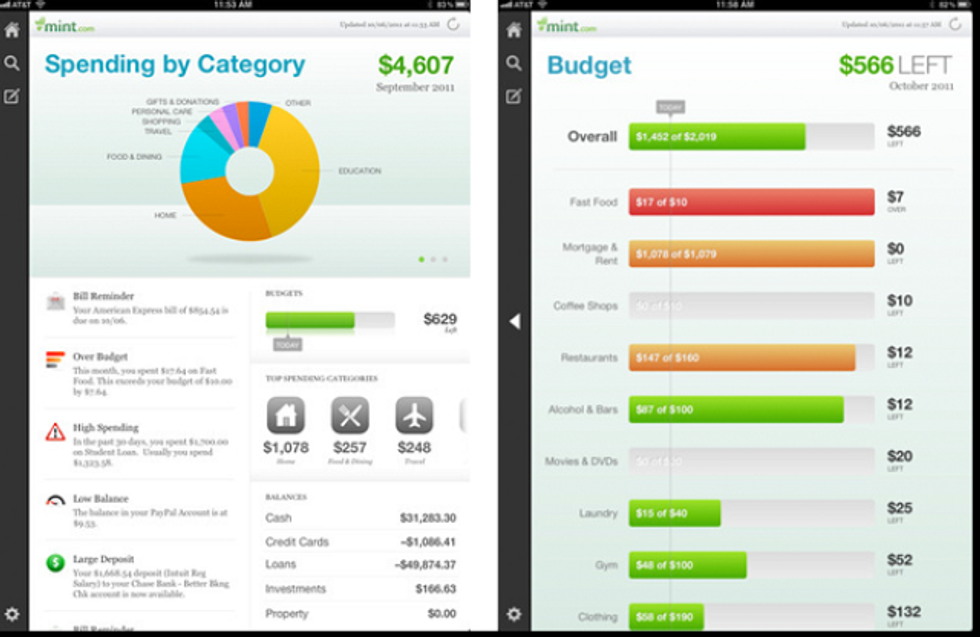

5. Track your spending

I'm really guilty about never checking my bank statement because it's always a huge reality check. We've all been there where we mentally think we have 100$ when we actually have 2.83$. Luckily apps like mint and good budget give you a set budget each month that help you stay on track.

6. Eating out

If you live off campus you'll probably find yourself eating out ALOT. Usually you just want something fast & cheap, but even eating fast food all the time can really add up. Making a bunch of pre-cooked meals at the beginning of the week will motivate you to eat at home more. Allow yourself to eat out once or twice a week, but only if it's super necessary.

7. Thrift Shopping

Some people might look down on thrift shopping, but in reality you can find some of the best stuff at Goodwill! Especially if you're buying dishes or furniture, thrift stores will always have it at fraction of the original price.

8. Shop at Sam's or Costco

If you have a Sam's or Costco card make sure you're putting it to good use! Buying in bulk is always cheaper, and will keep you from having to make grocery runs every other day.

9. Amazon

If you're going to shop anywhere online make sure it's amazon. These are the lowest prices on the market especially if you have amazon prime with free shipping! (just make sure you don't activate the one click buy because that's when things get dangerous)

10. Plan cheap activities with your friends

Hanging out with your friends shouldn't be a financial burden so plan things like having a picnic or having a bonfire that are just as fun.