In recent years, the US government has been addressing poor underwriting practices on the part of large commercial lending banks. Thus in an effort to relieve itself from the watchful eye of the Federal Housing Administration (FHA), Wells Fargo, has paired up with Fannie Mae in an effort to provide mortgage loans to individuals with low credit scores at an interest rate of three percent. The mortgage lending insurance agency has allegedly claimed in a lawsuit against Wells Fargo and other financial institutions, that lenders distorted underwriting practices in order to reap favorable results. One might perceive a movement away from the FHA government agency would induce less risky practices as the lenders are no longer insured. However, Fannie Mae is simply another government agency (government sponsored enterprise) providing a different type of insurance as well as a liquid secondary mortgage securities market. Shadows from our past mortgage crisis?

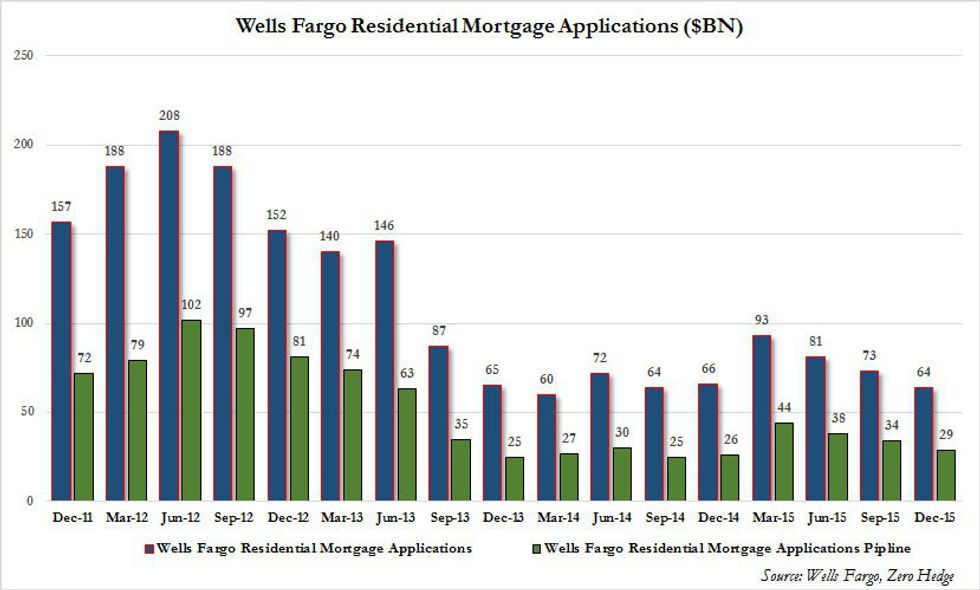

Wells Fargo’s mortgage volume has been in decline for the past few years, as a result the bank is anxious to bolster its mortgage lending base.

As the FHA has declined to assume the risk from Wells Fargo’s risky lending practices, a new credit union, Self Help Credit Union, as well as Fannie Mae has agreed to assume the risk for these loans. One can compare these same practices to pre housing crisis behavior. To reiterate, these are loans being extended at three percent to individuals with very high credit risk, and being backed by the credit union as well as the American tax payers through the involvement of Fannie Mae. One cannot claim amnesia anymore, however, this issue can be identified as one of poor incentives. The prominent point at hand is that once these risky loans default, Self Help Credit Union will be underwater (defaults exceed healthy performing loans) and the American tax payer will once again absorb the losses perpetuated by Fannie Mae and Wells Fargo.