The Expense Of Hurricanes Should Not Be A Burden For Everyone

Imagine if the state of Florida stepped in and stopped the rebuilding and development of these areas that are prone to devastation, may cause the possibility of lowering homeowners' insurance for the rest of the citizens in Florida.

The 2019 hurricane season starts in less than two months and I am wondering with the devastation that these storms cause on the shores of our country, when do we decide enough is enough and not allow victims to return and rebuild.

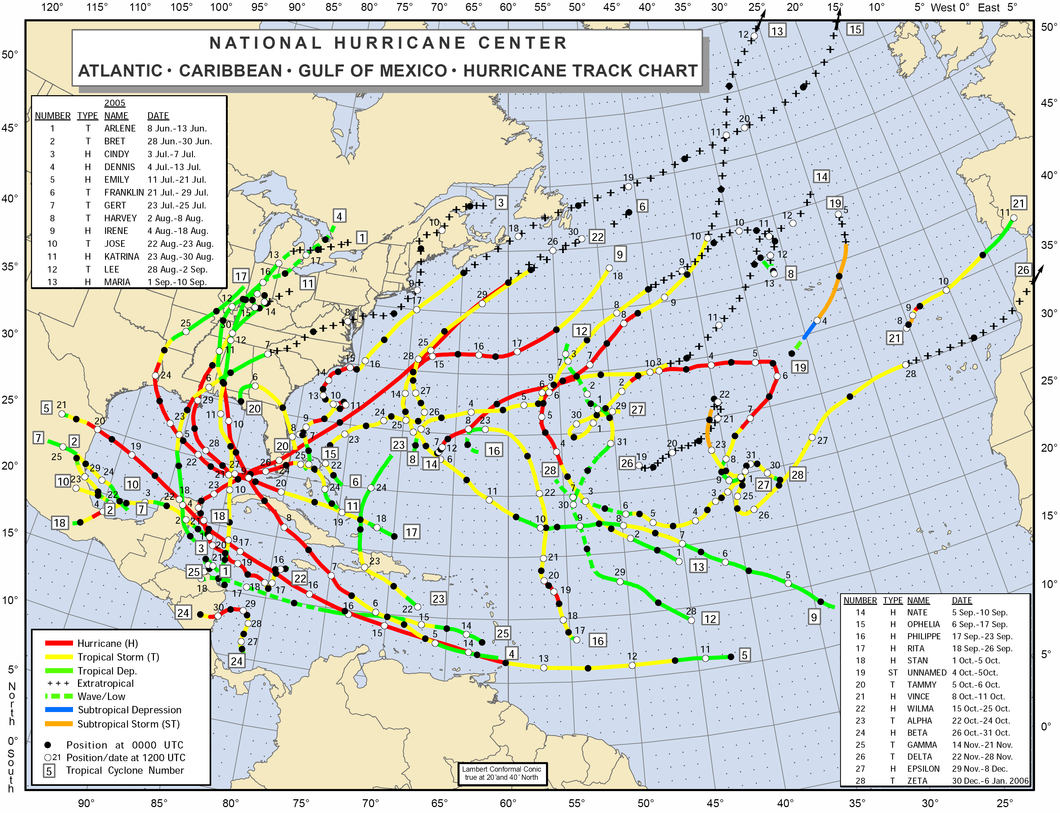

The official season for hurricanes is June 1st through November 30th. However, I want to focus primarily on the Florida coastal waters and the effects hurricanes have had on the state. Hurricane Michael depleted over and above the funds allocated for last year's storm season and it looks like Florida will start this season at a loss once again.

After Hurricane Andrew, the Florida Legislature created the Florida Hurricane Catastrophe Fund (FHCF). "The FHCF acts as a state-administered reinsurance program and is mandatory for residential property insurers writing covered policies in Florida. As of June 2018, this fund has a loss of ($1,279,762.00). The amount posted for hurricane losses is $2.5 billion. This loss was recorded well in advance of Hurricane Michael, hitting the panhandle in October 2018 with an estimated cost of damages of $25 billion.

Citizens Property Insurance Corporation was also established after Hurricane Andrew. It was created to provide coverage for home-owners that can't obtain insurance elsewhere. It is a not-for-profit insurer and is considered a last resort for homeowners. As the price of new homes increases so does the rate of homeowner insurance and many homeowners from the Keys to the Panhandle have seen their rates increase annually by 10% since 2010. This begs the question, why would anyone want to keep paying higher homeowners insurance year after year? With a higher percentage of Florida citizens in the retirement age, it seems that owning a home is more of a burden in areas that are prone to hurricanes.

When Hurricane Maria devasted Puerto Rico, it left the entire island in need of massive infrastructure rebuilding. Not only the political implications of the lack of funding for the island, but the images of destruction and personal suffering was heart-wrenching. Some are of the belief there is an economic benefit from a hurricane. After the initial blow to retail, fast food, and hospitals, there is a regrowth that puts many people back to work, if only for a temporary period and another hurricane does not come to make its way to that area for the next seven to ten years.

Yet, according to https://www.gfdl.noaa.gov/global-warming-and-hurricanes/, their models project that Atlantic hurricanes and tropical storms are substantially reduced in number, but have higher rainfall rates, particularly near the storm center, as well as potential higher intensity. This can be true for winter storms as well. Many of us have been caught in an airport or up in a northern state in the winter months and have difficulty returning to the sunshine state because of a storm that has pounded inches of snow along its path like a hurricane from the frozen tundra.

No one should be allowed to build a home in a floodplain or a flood zone. For that matter, areas that have been prone to wildfires, or fault lines. If every state looked at the areas that have been continuously destroyed by mother nature, and calculated the cost incurred to rebuild, decided to stop the bleeding and zone those areas as hazards, uninhabitable, or just government property, they will save billions of dollars for other much-needed services.

Imagine if the state of Florida stepped in and stopped the rebuilding and development of these areas that are prone to devastation, may cause the possibility of lowering homeowners' insurance for the rest of the citizens in Florida. The basic questions are, should Florida allow citizens to rebuild once their homes have been destroyed by a tropical storm? Think of it as an automobile, if the house is totaled the insurance company replaces the home. Just not in the same location.

The government has a duty to protect its citizens, and by that definition are in their rights to tell homeowners and developers the devastated area is no longer available for rebuilding. At what cost both financially and in human lives do the citizens of Florida allow the coastlines to be developed or rebuilt? If the developers and homeowners can rebuild the rest of the taxpayers and homeowners should not have to pay the increase in insurance rates or a hurricane relief tax.

The taxpayers of Florida don't want to pay a hurricane tax, they don't have a choice. Their elected officials side with the developers and the large money donor homeowners. Maybe the beach that has that $2 million home isn't meant to be there. Of course, there is a great view and the ocean or gulf coast is at your feet, as the shoreline slowly covers your property. Yet the erosion isn't going to happen in the next few years so why worry?

I can't understand why a person wants to own a home that no insurance company will insure. If these million-dollar homes on beaches meant for sunbathing, surfing, fishing, and Florida wildlife, are forever a part of Florida, maybe these homeowners need to be self-insured. Be solely responsible for the environment they own. Yet, the state of Florida has created legislation to help these people and can't figure out how to make affordable housing for the rest of the state.