How to Start Your Own Non-Profit

If you’re thinking about starting your own nonprofit, this can be an inspiring way to help your community and those in need, but knowing how to start it is the most important step.

If you’re thinking about starting your own nonprofit, this can be an inspiring way to help your community and those in need. First, knowing how to start it is the most important step.

The process of starting a nonprofit involves several steps before you move forward. Yet, with great determination, you can achieve your goal of establishing a successful nonprofit organization.

It’s important to note that these steps offer general guidance on starting a nonprofit organization. Therefore, you may consider consulting with a legal or tax professional — as these steps will vary by state.

Otherwise, here is a closer look at the steps you can take to start a nonprofit.

1. Research

Before you commit to starting a nonprofit, you’ll need to research whether you can create one. To assess your feasibility, you should determine whether you have the financial resources.

The initial startup cost for nonprofit organizations is $858.79 on average. This includes legal fees, registration, administrative fees and other startup costs.

Additionally, you should find out if people require your services in your area and if other organizations like yours already exist. It can be more challenging to gather support if you find out there’s no need for your services.

It would help if you also considered whether this is right for you. Public charities must operate at a level exclusive to tax-exempt organizations according to section 501(c)(3) of the Internal Revenue code.

However, if you start a nonprofit, you can receive grant money — but this is not to pay your salary. If that is your goal, creating a nonprofit isn’t right for you.

2. Establish a Strong Foundation

Draft a Mission Statement

Writing a mission statement is critical to communicating your nonprofit’s purpose and maintaining a focus of your internal team. Keep it simple while writing your mission statement. You only need a sentence or two to describe the service you provide, and the core values your organization holds.

Additionally, it helps to write your mission statement in a concise and basic format so everyone can understand your overall goal.

Write a Business Plan

Like a for-profit business, a business plan is essential for nonprofit organizations. That way, they can describe how they plan to achieve their mission in more detail.

Business plans can also be useful for outlining a new venture or project.

Choose Your Board of Directors

Your nonprofit will need a governing body to fulfill various roles and legal responsibilities. Consider starting the recruitment process by making a list of skills and expertise your nonprofit requires to achieve its mission.

You can then create a list of people that share these qualifications and interests in your cause. Once you discuss their involvement, you may assess them for a board position by asking them to volunteer. This action will help you see if they are a good fit for a board role.

3. Incorporate Your Nonprofit

Incorporating your nonprofit is essential for having the state recognize you as a business. In addition, it limits your organization’s officers’ liability. To file the articles of incorporation, you must determine which office in your state does business filing.

The office names for each state are different, including the steps and documentation required for filing.

4. File for a Tax-Exempt Status

Filing a tax-exempt status will vary depending on the type of nonprofit you intend to start. Therefore, it’s important to check with the Internal Revenue Service to learn which tax-exempt status you can file.

5. Maintain Compliance

Once you achieve a tax-exempt status, you’ll need to maintain it by keeping a checklist.

File Federal and State Taxes

Each year, you will need to file taxes using a 990 form or 990-EZ at the federal level. Not all states require this, but many do request it. The benefits of these forms showcase how you manage your funds, avoid conflicts of interest and may attract new donors.

Adhere to Bylaws

Bylaws give you a plan for running your organization legally and ethically. These include details such as:

- When to meet with your board.

- How to avoid conflicts.

- How you should spend your donations.

Follow the bylaws carefully and use them to make informed decisions.

Keep Track of Detailed Records

You must keep records of your nonprofit’s activities to keep your tax-exempt status. These include financial statements such as expenses, revenue, grants and check cancellations. Proof of how you use your funds is key to maintaining your tax-exempt status.

Start Your Nonprofit Today

Forming a nonprofit can be quite a process, but it is achievable if you have everything in the right order. Remember that it will require much time, effort and even legal expertise. Yet, once you follow the right steps — you can start taking action to help your nonprofit succeed in its mission.

https://veronicarothbooks.com/books/divergent/

https://veronicarothbooks.com/books/divergent/ www.instagram.com

www.instagram.com Instagram (@britneyreads-- my personal bookstagram)

Instagram (@britneyreads-- my personal bookstagram) The Mortal Instruments Series Collection 1-6 by Cassandra Clare

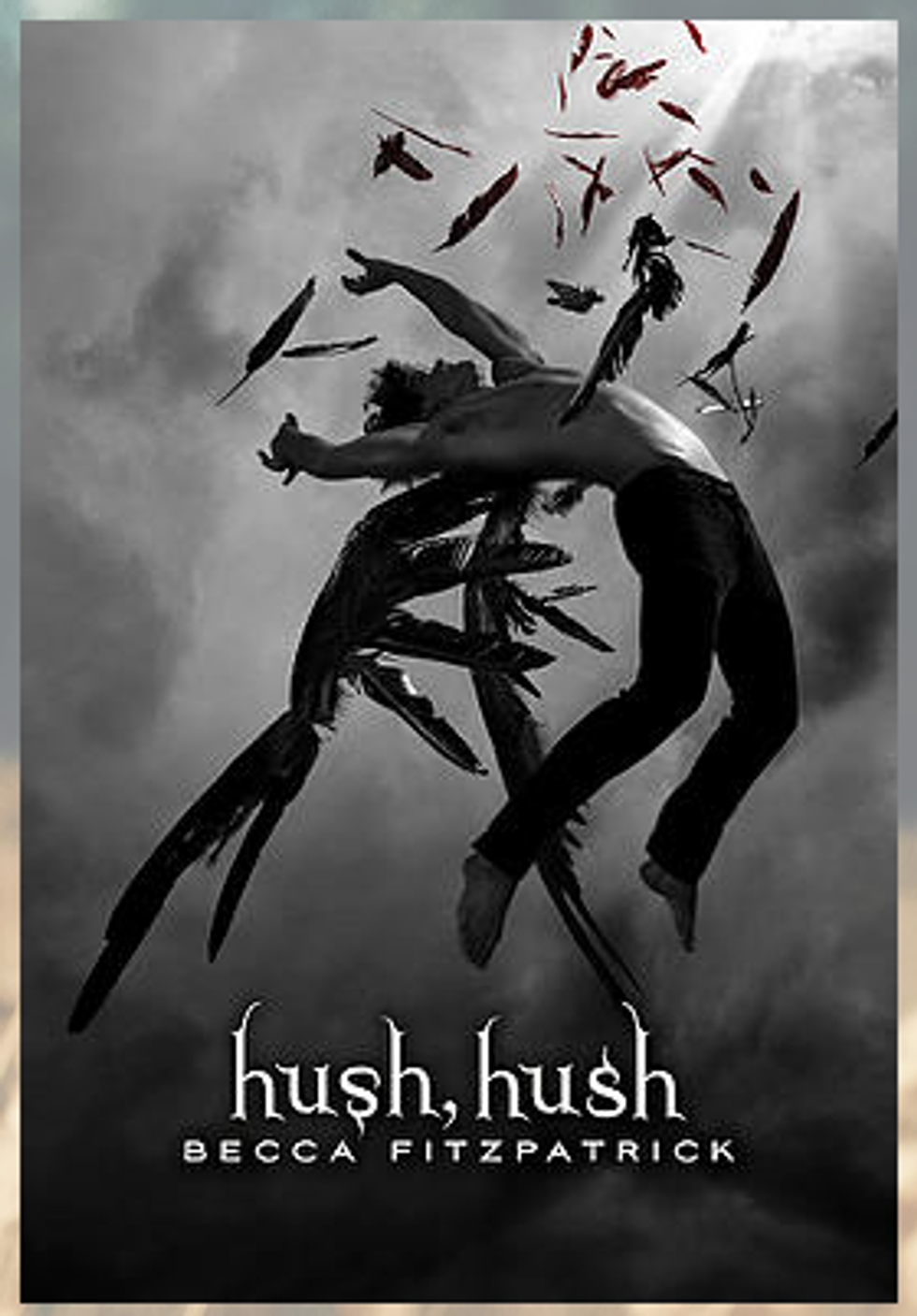

The Mortal Instruments Series Collection 1-6 by Cassandra Clare https://www.beccafitzpatrick.com

https://www.beccafitzpatrick.com