.

Have you ever heard about interest on a loan? You must have noticed that the loan providers always take the fees for providing loans. The fee is in the form of interest that can be high or low varying from one lender to another. The interest rate is needed to pay along with the loan amount in the repayment duration.

Some loan providers charge high-interest rates to the borrowers to earn more money by providing loans. The high-interest rate sometimes becomes very problematic for the borrowers as it increases the loan amount to the maximum. If you want to get a loan at a low-interest rate then the best way is to get help from a broker service provider.

Broker service providers are available on the internet which provides the opportunity to get loans that you desire. To give you a helping hand we have explained the most amazing broker service provider on the internet in the given list. All the details regarding the procedure are discussed below:

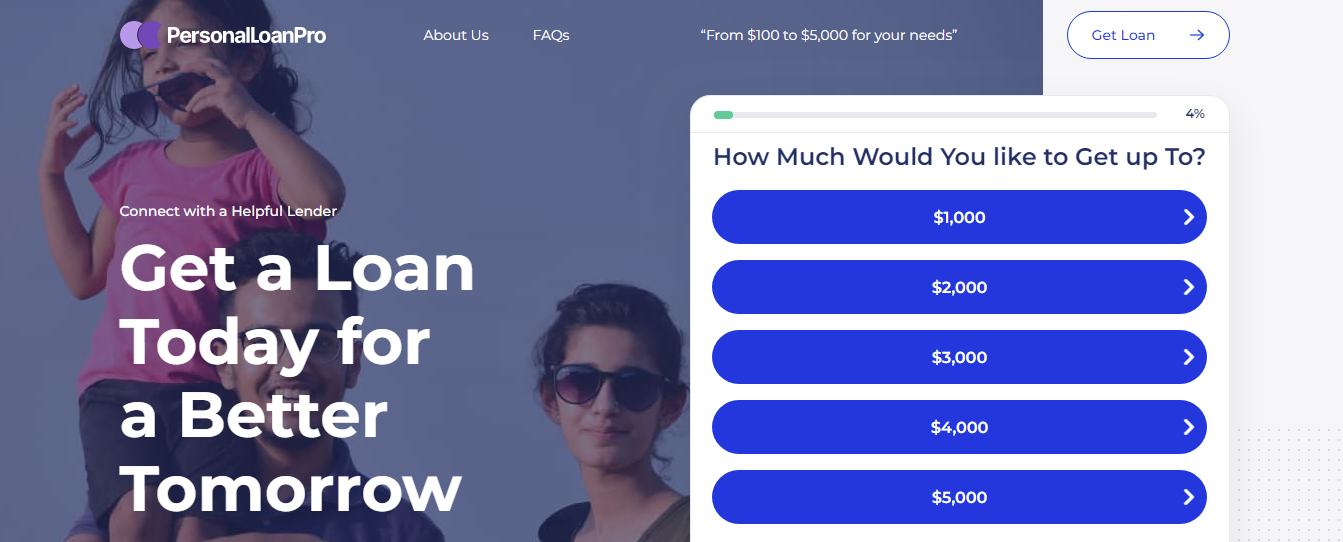

Personal Loan Pro

Whenever professionals are asked for a broker service provider that provides an opportunity to get a loan with a low-interest rate then Personal Loan Pro website always remains top of the list. The platform contains many lenders in its connections that offer affordable interest rates for the borrowers for ease.

The platform works to provide all the broker services for free and gives a simple interface to the borrowers. You can also enjoy a quick response from the lenders without any delay hence the money would be in your account as quickly as the same day.

Merits:

- Free: A borrower can enjoy all the broker services for free on this platform. It is a platform that gives a large number of facilities at one interface as this link explains everything.

- Online: You can apply for a loan and get the response or loan amount online in your comfort zone.

- Active: This platform is active in providing services hence you can enjoy quick responses here.

- Easy: The interface is easy so that beginners can also use it.

- Secure: A borrower can enjoy the security of confidential information on this platform.

Demerits:

- If you are applying for a loan, a borrower must be above 18 years of age.

US Title Loans

US Title Loans are available for the ones that want a loan on an immediate basis. You can quickly get a Title Loan just by providing your precious asset as collateral. The website is going to protect the collateral until you repay the loan. If a person doesn't pay a loan amount in its duration then the collateral becomes under the ownership of the lender.

Merits:

- You can enjoy a simple interface on this platform.

- Quick services are provided with the collateral.

- You can get your asset back after paying the loan.

Demerits:

- A person would lose the ownership of the collateral if she/he wouldn't pay the loan in its duration.

US Installment Loans

Sometimes a person cannot repay the loan amount in its time duration due to the financial crisis or unemployment. In this situation, US Installment Loans provides an opportunity to make the installment of your loan up to your desired duration. You can also choose the number of installments along with the payment of each installment.

Merits:

- You can find a lender on your desired terms and conditions.

- You don't need to compromise through this platform.

- The platform charges nothing for its services.

Demerits:

- A borrower needs to provide the real name, ID, and other credentials to the loan provider otherwise the loan wouldn't be provided.

CocoLoan

If a borrower is fed up with the hard credit check by the lenders then you can get rid of it through CocoLoan. The platform provides you broker services through which you can find a lender that provides a credit check. Now you don't need to worry about your credit score as the services are provided to protect it.

Merits:

- The platform does not restrict hard credit checks.

- You can find a lender that offers a soft credit check.

- The platform works to protect the credit score of the borrowers.

Demerits:

- A person must have a steady source of income otherwise the platform does not entertain the broker services.

iPaydayLoans

If you want a loan provider that gives you an opportunity even though with a bad credit score then iPaydayLoans is here for you. The platform allows different functionalities and features to the bad credit holders without making any distinction from the good ones. The entire procedure would be quick and easy for you without any hurdles.

Merits:

- You can apply for a loan even with a bad credit score.

- All the facilities are provided without making any distinctions.

- It has a quick procedure for loan requests.

Demerits:

- The platform is only available for the residents of the USA.

How To Get A Personal Loan With Low-Interest Rates In The US?

If you are a resident of the USA, you would understand that finding a loan provider that offers low-interest rates would be a complex procedure. You can make this procedure easy with the well-known tool Personal Loan Pro. You just need to follow the given procedure to find a loan provider of your desire:

Step 1: Application Submission

First, a person needs to fill out an online application form that needs important credentials of a person. After entering the information the borrower allowed the website to provide the information to the different lenders in the connections.

Step 2: Selecting A Lender

The lenders review the information and then approach you with offers. You need to select a lender and the website will give you the direct link to the lender. You need to head toward the lender's website and then review the terms and conditions.

Step 3: Get Your Loan Amount

If you are satisfied with the terms and conditions of the lender then an online agreement is signed between both parties. The money would be directly transferred to the borrower's account after the confirmation from the lender's side.

Sum Up

Interest is always charged by lenders as a fee for giving loans to borrowers. The interest rate can be high or low according to the lender. A borrower always wants a loan provider that offers a loan at an affordable interest rate. The best thing in this situation is to get help from a broker service provider. We have provided a list of the most active broker service providers on the internet for you. You need to have a look at the list and find the best option for you here.

women in street dancing

Photo by

women in street dancing

Photo by  man and woman standing in front of louver door

Photo by

man and woman standing in front of louver door

Photo by  man in black t-shirt holding coca cola bottle

Photo by

man in black t-shirt holding coca cola bottle

Photo by  red and white coca cola signage

Photo by

red and white coca cola signage

Photo by  man holding luggage photo

Photo by

man holding luggage photo

Photo by  topless boy in blue denim jeans riding red bicycle during daytime

Photo by

topless boy in blue denim jeans riding red bicycle during daytime

Photo by  trust spelled with wooden letter blocks on a table

Photo by

trust spelled with wooden letter blocks on a table

Photo by  Everyone is Welcome signage

Photo by

Everyone is Welcome signage

Photo by  man with cap and background with red and pink wall l

Photo by

man with cap and background with red and pink wall l

Photo by  difficult roads lead to beautiful destinations desk decor

Photo by

difficult roads lead to beautiful destinations desk decor

Photo by  photography of woman pointing her finger near an man

Photo by

photography of woman pointing her finger near an man

Photo by  closeup photography of woman smiling

Photo by

closeup photography of woman smiling

Photo by  a man doing a trick on a skateboard

Photo by

a man doing a trick on a skateboard

Photo by  two men

two men  running man on bridge

Photo by

running man on bridge

Photo by  orange white and black bag

Photo by

orange white and black bag

Photo by  girl sitting on gray rocks

Photo by

girl sitting on gray rocks

Photo by  assorted-color painted wall with painting materials

Photo by

assorted-color painted wall with painting materials

Photo by  three women sitting on brown wooden bench

Photo by

three women sitting on brown wooden bench

Photo by

Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by

people sitting on chair in front of computer

people sitting on chair in front of computer

all stars lol GIF by Lifetime

all stars lol GIF by Lifetime two women talking while looking at laptop computerPhoto by

two women talking while looking at laptop computerPhoto by  shallow focus photography of two boys doing wacky facesPhoto by

shallow focus photography of two boys doing wacky facesPhoto by  happy birthday balloons with happy birthday textPhoto by

happy birthday balloons with happy birthday textPhoto by  itty-bitty living space." | The Genie shows Aladdin how… | Flickr

itty-bitty living space." | The Genie shows Aladdin how… | Flickr shallow focus photography of dog and catPhoto by

shallow focus photography of dog and catPhoto by  yellow Volkswagen van on roadPhoto by

yellow Volkswagen van on roadPhoto by  orange i have a crush on you neon light signagePhoto by

orange i have a crush on you neon light signagePhoto by  5 Tattoos Artist That Will Make You Want A Tattoo

5 Tattoos Artist That Will Make You Want A Tattoo woman biting pencil while sitting on chair in front of computer during daytimePhoto by

woman biting pencil while sitting on chair in front of computer during daytimePhoto by  a scrabbled wooden block spelling the word prizePhoto by

a scrabbled wooden block spelling the word prizePhoto by

StableDiffusion

StableDiffusion

StableDiffusion

StableDiffusion

StableDiffusion

StableDiffusion