25 Beatles Lyrics: Your Go-To Guide for Every Situation

The Best Lines from the Fab Four

For as long as I can remember, I have been listening to The Beatles. Every year, my mom would appropriately blast “Birthday” on anyone’s birthday. I knew all of the words to “Back In The U.S.S.R” by the time I was 5 (Even though I had no idea what or where the U.S.S.R was). I grew up with John, Paul, George, and Ringo instead Justin, JC, Joey, Chris and Lance (I had to google N*SYNC to remember their names). The highlight of my short life was Paul McCartney in concert twice. I’m not someone to “fangirl” but those days I fangirled hard. The music of The Beatles has gotten me through everything. Their songs have brought me more joy, peace, and comfort. I can listen to them in any situation and find what I need. Here are the best lyrics from The Beatles for every and any occasion.

And in the end, the love you take is equal to the love you make

The End- Abbey Road, 1969

The sun is up, the sky is blue, it's beautiful and so are you

Dear Prudence- The White Album, 1968

Love is old, love is new, love is all, love is you

Because- Abbey Road, 1969

There's nowhere you can be that isn't where you're meant to be

All You Need Is Love, 1967

Life is very short, and there's no time for fussing and fighting, my friend

We Can Work It Out- Rubber Soul, 1965

He say, "I know you, you know me", One thing I can tell you is you got to be free

Come Together- Abbey Road, 1969

Oh please, say to me, You'll let me be your man. And please say to me, You'll let me hold your hand

I Wanna Hold Your Hand- Meet The Beatles!, 1964

It was twenty years ago today, Sgt. Pepper taught the band to play. They've been going in and out of style, but they're guaranteed to raise a smile

Sgt. Pepper's Lonely Hearts Club Band-1967

Living is easy with eyes closed, misunderstanding all you see

Strawberry Fields Forever- Magical Mystery Tour, 1967

Can you hear me? When it rains and shine, it's just a state of mind

Rain- Paperback Writer "B" side, 1966

Little darling, it's been long cold lonely winter. Little darling, it feels like years since it' s been here. Here comes the sun, Here comes the sun, and I say it's alright

Here Comes The Sun- Abbey Road, 1969

We danced through the night and we held each other tight, and before too long I fell in love with her. Now, I'll never dance with another when I saw her standing there

Saw Her Standing There- Please Please Me, 1963

I love you, I love you, I love you, that's all I want to say

Michelle- Rubber Soul, 1965

You say you want a revolution. Well you know, we all want to change the world

Revolution- The Beatles, 1968

All the lonely people, where do they all come from. All the lonely people, where do they all belong

Eleanor Rigby- Revolver, 1966

Oh, I get by with a little help from my friends

With A Little Help From My Friends- Sgt. Pepper's Lonely Hearts Club Band, 1967

Hey Jude, don't make it bad. Take a sad song and make it better

Hey Jude, 1968

Yesterday, all my troubles seemed so far away. Now it looks as though they're here to stay. Oh, I believe in yesterday

Yesterday- Help!, 1965

And when the brokenhearted people, living in the world agree, there will be an answer, let it be.

Let It Be- Let It Be, 1970

And anytime you feel the pain, Hey Jude, refrain. Don't carry the world upon your shoulders

Hey Jude, 1968

I'll give you all I got to give if you say you'll love me too. I may not have a lot to give but what I got I'll give to you. I don't care too much for money. Money can't buy me love

Can't Buy Me Love- A Hard Day's Night, 1964

All you need is love, love is all you need

All You Need Is Love- Magical Mystery Tour, 1967

Whisper words of wisdom, let it be

Let It Be- Let It Be, 1970

Blackbird singing in the dead of night, Take these broken wings and learn to fly. All your life, You were only waiting for this moment to arise

Blackbird- The White Album, 1968

Though I know I'll never lose affection, for people and things that went before. I know I'll often stop and think about them. In my life, I love you more

In My Life- Rubber Soul, 1965

While these are my 25 favorites, there are quite literally 1000s that could have been included. The Beatles' body of work is massive and there is something for everyone. If you have been living under a rock and haven't discovered the Fab Four, you have to get musically educated. Stream them on Spotify, find them on iTunes or even buy a CD or record (Yes, those still exist!). I would suggest starting with 1, which is a collection of most of their #1 songs, or the 1968 White Album. Give them chance and you'll never look back.

woman doing manicure

Photo by

woman doing manicure

Photo by  3. I'll have a blood orange ombré.

Picaso Nails

3. I'll have a blood orange ombré.

Picaso Nails

person wearing gold ring holding black textile

Photo by

person wearing gold ring holding black textile

Photo by  selective focus photography of woman's pink manicure

Photo by

selective focus photography of woman's pink manicure

Photo by  persons hand on pink surface

Photo by

persons hand on pink surface

Photo by  white clouds during daytime

Photo by

white clouds during daytime

Photo by  multicolored hallway

Photo by

multicolored hallway

Photo by

Going to the cinema alone is good for your mental health, says science

Going to the cinema alone is good for your mental health, says science

Photo by

Photo by  Photo by

Photo by  StableDiffusion

StableDiffusion StableDiffusion

StableDiffusion StableDiffusion

StableDiffusion StableDiffusion

StableDiffusion

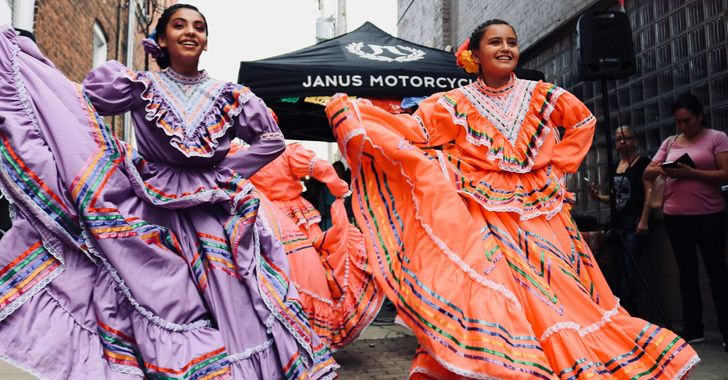

women in street dancing

Photo by

women in street dancing

Photo by  man and woman standing in front of louver door

Photo by

man and woman standing in front of louver door

Photo by  man in black t-shirt holding coca cola bottle

Photo by

man in black t-shirt holding coca cola bottle

Photo by  red and white coca cola signage

Photo by

red and white coca cola signage

Photo by  man holding luggage photo

Photo by

man holding luggage photo

Photo by  topless boy in blue denim jeans riding red bicycle during daytime

Photo by

topless boy in blue denim jeans riding red bicycle during daytime

Photo by  trust spelled with wooden letter blocks on a table

Photo by

trust spelled with wooden letter blocks on a table

Photo by  Everyone is Welcome signage

Photo by

Everyone is Welcome signage

Photo by  man with cap and background with red and pink wall l

Photo by

man with cap and background with red and pink wall l

Photo by  difficult roads lead to beautiful destinations desk decor

Photo by

difficult roads lead to beautiful destinations desk decor

Photo by  photography of woman pointing her finger near an man

Photo by

photography of woman pointing her finger near an man

Photo by  closeup photography of woman smiling

Photo by

closeup photography of woman smiling

Photo by  a man doing a trick on a skateboard

Photo by

a man doing a trick on a skateboard

Photo by  two men

two men  running man on bridge

Photo by

running man on bridge

Photo by  orange white and black bag

Photo by

orange white and black bag

Photo by  girl sitting on gray rocks

Photo by

girl sitting on gray rocks

Photo by  assorted-color painted wall with painting materials

Photo by

assorted-color painted wall with painting materials

Photo by  three women sitting on brown wooden bench

Photo by

three women sitting on brown wooden bench

Photo by

Do you wet the toothbrush before or after toothpaste? People are divided...

Do you wet the toothbrush before or after toothpaste? People are divided...

I Love You GIF by Taylor Swift

I Love You GIF by Taylor Swift Behind The Scenes GIF by Taylor Swift

Behind The Scenes GIF by Taylor Swift taylor swift dancing GIF

taylor swift dancing GIF Happy Music Video GIF

Happy Music Video GIF Taylor Swift G GIF - Find & Share on GIPHY

Taylor Swift G GIF - Find & Share on GIPHY

taylor swift grammys GIF by mtv

taylor swift grammys GIF by mtv Taylor Swift GIF

Taylor Swift GIF taylor swift yes GIF

taylor swift yes GIF taylor swift love GIF

taylor swift love GIF

woman putting red sauce on hamburger

Photo by

woman putting red sauce on hamburger

Photo by  person holding black frying pan

Photo by

person holding black frying pan

Photo by  cracked Oreo cookies

Photo by

cracked Oreo cookies

Photo by  a man laying in the grass with a bottle of vodka

Photo by

a man laying in the grass with a bottle of vodka

Photo by  person pouring milk on clear drinking glass

Photo by

person pouring milk on clear drinking glass

Photo by  person using laptop browsing facebook application

Photo by

person using laptop browsing facebook application

Photo by  person holding white toilet paper roll

Photo by

person holding white toilet paper roll

Photo by  woman in black long sleeve shirt using macbook

Photo by

woman in black long sleeve shirt using macbook

Photo by  person holding space gray iPhone X

Photo by

person holding space gray iPhone X

Photo by  five Monster Energy cans

Photo by

five Monster Energy cans

Photo by  a sign that says see you later hanging from a door

Photo by

a sign that says see you later hanging from a door

Photo by  white cotton buds in container

Photo by

white cotton buds in container

Photo by  person holding black gas station pump

Photo by

person holding black gas station pump

Photo by  woman spread hand

Photo by

woman spread hand

Photo by  black haired man making face

Photo by

black haired man making face

Photo by  person holding space gray iPhone X

Photo by

person holding space gray iPhone X

Photo by  pile of oak barrels inside tunnel

Photo by

pile of oak barrels inside tunnel

Photo by  brown hair with aluminum foil on hair pieces

Photo by

brown hair with aluminum foil on hair pieces

Photo by  a person sitting on a bench with a subway bag of food

Photo by

a person sitting on a bench with a subway bag of food

Photo by  woman in dark-blue blazer carrying green purse

Photo by

woman in dark-blue blazer carrying green purse

Photo by  silhouette of woman holding rectangular board

Photo by

silhouette of woman holding rectangular board

Photo by  a wooden gaven sitting on top of a computer keyboard

Photo by

a wooden gaven sitting on top of a computer keyboard

Photo by  grayscale photo of 1-21 Wall street signage

Photo by

grayscale photo of 1-21 Wall street signage

Photo by  a sign that is lit up in the dark

Photo by

a sign that is lit up in the dark

Photo by

women's black brassiere

Photo by

women's black brassiere

Photo by  photo of blue and pink painted high-rise building

Photo by

photo of blue and pink painted high-rise building

Photo by  woman in blue sleeveless dress wearing blue and white floral tiara

Photo by

woman in blue sleeveless dress wearing blue and white floral tiara

Photo by  person carrying yellow and black backpack walking between green plants

Photo by

person carrying yellow and black backpack walking between green plants

Photo by  aerial photography of baseball stadium

Photo by

aerial photography of baseball stadium

Photo by  white and brown bottle beside white tissue box

Photo by

white and brown bottle beside white tissue box

Photo by  sea waves crashing on shore during daytime

Photo by

sea waves crashing on shore during daytime

Photo by  fawn pug covered by Burberry textile between plants

Photo by

fawn pug covered by Burberry textile between plants

Photo by  brown pathway between green plants

Photo by

brown pathway between green plants

Photo by

Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  StableDiffusion

StableDiffusion

StableDiffusion

StableDiffusion

Photo by

Photo by  StableDiffusion

StableDiffusion

Photo by

Photo by