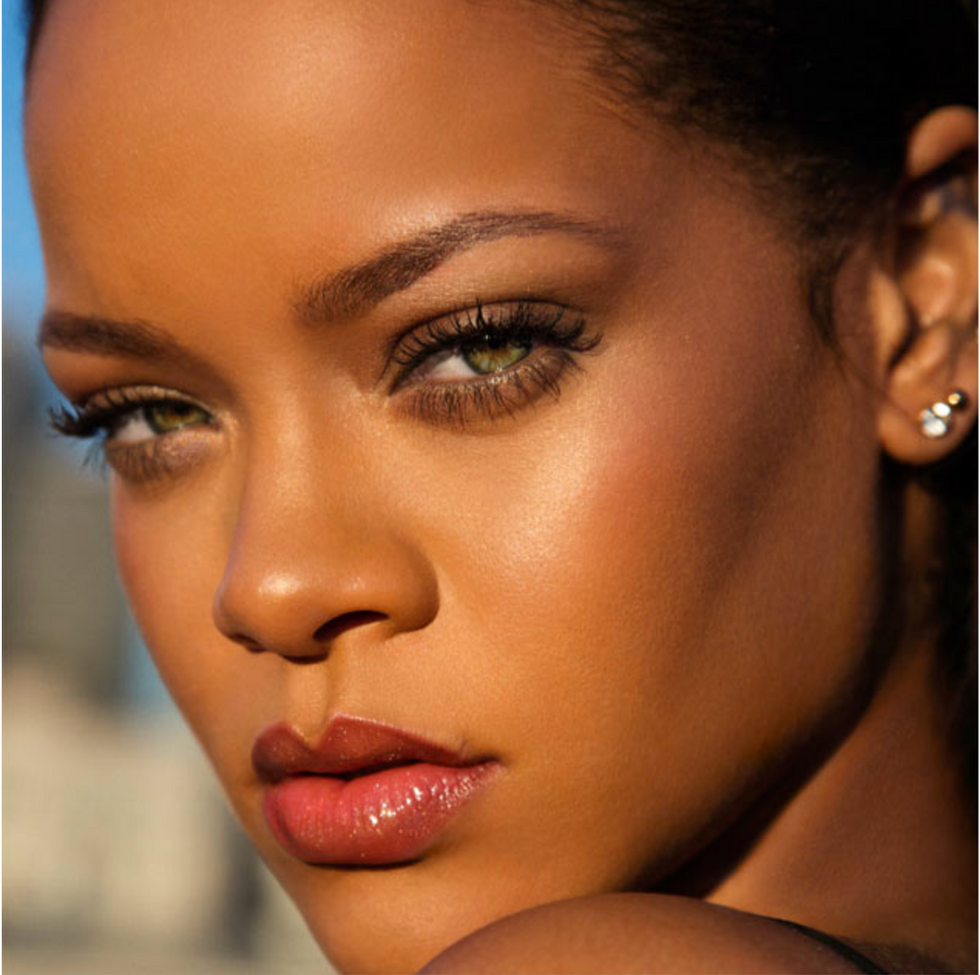

Rihanna’s new makeup line, Fenty Beauty, is already making noise to makeup fanatics everywhere. Launched in over 1,600 stores and in 17 countries around the globe, this makeup line represents unity and inclusivity among women everywhere. Inspired by her love for makeup as a child this line allows every woman to express herself just as the culture icon Rihanna does.

Although Rihanna’s love for make-up contributed to the initiation of her line, what drove her vision was the beauty industries lack of diversity. She saw that the span of colors offered in high-end makeup lines failed to include pigments that complimented a variety of unique skin tones and types. Fenty is created specifically to fill a gap in the beauty world.

The line offers 40 shades of foundation to fill this void offering diverse shades which target “hard to match” skin tones. Additionally, 20 shades of makeup sticks and a healthy span of highlighters and lipsticks are offered. The line is ubiquitous revealing the true essence of the brand. In an interview with E News, Rihanna comments that “I want women of all shades to feel included…” and “that was important for me within choosing the shades.” Her website evens says that the line exists “so that women everywhere would be included.” Women of every ethnicity, race, and culture, can now lavish in the method self-expression that is makeup.

Another important aspect of the music icon’s line was the image of the “Fenty Face.” In a video featured on the Fenty Beauty website, it shows the “Fenty Face” in various application on a diverse group of women of various cultures. Rihanna recognizes that beauty is subjective and exists in all different styles. Rihanna said the reason she named the brand “Fenty” was because her name was personal to her and she wanted this line to represent how she sees beauty.

This line of makeup is for the girls and for the women. The line promotes beauty, and self-confidence and inclusion while celebrating women in their essence. “We are women and we have challenges” says the singing sensation, “we deserve to feel beautiful.”

people sitting on chair in front of computer

people sitting on chair in front of computer

all stars lol GIF by Lifetime

all stars lol GIF by Lifetime two women talking while looking at laptop computerPhoto by

two women talking while looking at laptop computerPhoto by  shallow focus photography of two boys doing wacky facesPhoto by

shallow focus photography of two boys doing wacky facesPhoto by  happy birthday balloons with happy birthday textPhoto by

happy birthday balloons with happy birthday textPhoto by  itty-bitty living space." | The Genie shows Aladdin how… | Flickr

itty-bitty living space." | The Genie shows Aladdin how… | Flickr shallow focus photography of dog and catPhoto by

shallow focus photography of dog and catPhoto by  yellow Volkswagen van on roadPhoto by

yellow Volkswagen van on roadPhoto by  orange i have a crush on you neon light signagePhoto by

orange i have a crush on you neon light signagePhoto by  5 Tattoos Artist That Will Make You Want A Tattoo

5 Tattoos Artist That Will Make You Want A Tattoo woman biting pencil while sitting on chair in front of computer during daytimePhoto by

woman biting pencil while sitting on chair in front of computer during daytimePhoto by  a scrabbled wooden block spelling the word prizePhoto by

a scrabbled wooden block spelling the word prizePhoto by

StableDiffusion

StableDiffusion

StableDiffusion

StableDiffusion

StableDiffusion

StableDiffusion

women sitting on rock near body of waterPhoto by

women sitting on rock near body of waterPhoto by

Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by  Photo by

Photo by